WASHINGTON – Thrown in the middle of a heated political battle, a new federal agency formed to protect consumers is facing the new year without a chief director.

The Consumer Financial Protection Bureau began operating under the Federal Reserve Board last July. It was created by the Dodd-Frank Wall Street reform law enacted last year in response to the 2008 financial crisis.

At the same time last summer, 44 Republicans signed a letter vowing to filibuster the nomination of any director of the bureau, preventing President Barack Obama’s nominee – former Ohio Attorney General Richard Cordray – from being confirmed by Congress.

Sen. Lisa Murkowski, R-Alaska, and Sen. Scott Brown, R-Mass., did not sign the GOP letter, providing a sliver of hope that Republican sentiment toward the Cordray nomination may soften.

But due to back-and-forth politics on Capitol Hill, Cordray’s confirmation – while approved in committee – has yet to be voted on by the full Senate floor, leaving the director’s seat empty.

On Sunday, the White House released a 10-page report summaring the importance of a bureau director, a hint that the battle to confirm Cordray will continue through 2012.

Running on its own

In the meantime, the consumer bureau is operating under a special advisor, Raj Date, who reports to Treasury Secretary Timothy Geithner.

Date testified on Nov. 2 about the first 100 days of the agency’s operations. Without a director, he made it clear the financial bureau is still making progress toward its goal of providing transparency by educating consumers, supervising banks and credit unions, analyzing data and enforcing consumer financial laws.

The bureau has hired some 700 employees this year, less than one-fifth of the 3,600-person work force of the Securities and Exchange Commission – Washington’s oldest and largest financial regulator.

It also announced a number of initiatives including “Know What You Owe” for student loans, working with the Department of Education on this program to improve the way schools communicate loan and repayment information to students.

Consumers can also submit mortgage and credit card complaints to the bureau, which will forward the files to the lending companies and give a tracking number to follow the status.

Because the agency’s purpose as a consumer advocate is to police certain financial institutions, it has drawn a negative response from pro-business lobbying groups and organizations including the U.S. Chamber of Commerce.

The strongest pushback is from congressional Republicans, who have been against the consumer bureau since former bankruptcy lawyer Elizabeth Warren conceived the idea of a financial protection agency in 2010.

Warren, a Democrat, who previously led the oversight panel on the impact of the bank bailout funds following the 2008 subprime mortgage crisis, drew criticism for being too outspoken and became a polarizing figure in the financial regulatory debate.

She left the bureau in July, at which time Obama chose Cordray to lead the agency. Warren, in the meantime, decided to run for the U.S. Senate in Massachusetts.

Playing politics

Since the overhaul of the financial system, Republicans have been playing hardball against the Dodd-Frank regulations. The GOP demands the restructuring of the consumer bureau from a single director to a board of directors – the same structure as agencies such as the SEC and Commodity Futures Trading Commission – effectively weakening the power of the financial protection agency.

Since the overhaul of the financial system, Republicans have been playing hardball against the Dodd-Frank regulations. The GOP demands the restructuring of the consumer bureau from a single director to a board of directors – the same structure as agencies such as the SEC and Commodity Futures Trading Commission – effectively weakening the power of the financial protection agency.

“It has to be Congress to approve the changes,” said Mark Calabria, director of financial regulation studies at the Cato Institute, a libertarian-leaning think tank in Washington. “As long as there are Republicans in Senate, there will be no director.”

Furthermore, Republicans are unsatisfied the consumer bureau operates under the Federal Reserve and therefore receives funding through the central bank. Instead, Republicans prefer that the new agency stand alone and receive money through regular budget appropriations. Finally, conservatives want Congress to conduct a formal review of the bureau.

“Current financial regulators already evade accountability by claiming independence or recusing themselves when they fail,” said Sen. Richard Shelby, R-Ala., ranking member of the Senate Banking Committee. “The CFPB is unaccountable by design.”

Democrats are quick to defend the bureau and its mission.

“Improving transparency will help ensure that Americans are not tricked or trapped by hidden fees from big banks – but the CFPB needs a strong leader to effectively protect consumers,” said Senate Majority Whip Richard Durbin, D-Ill.

Doing its job

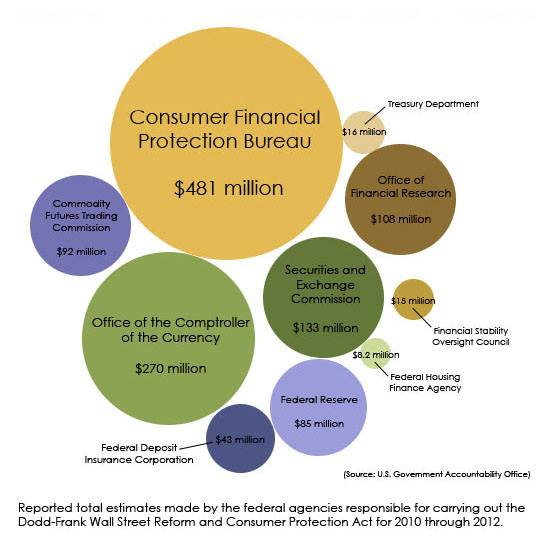

The consumer bureau for families and individual borrowers is one of 10 federal agencies that requires funds to carry out the mandated duties of the Dodd-Frank financial reform legislation.

The agency estimated that it needs roughly $481 million through 2012, according to the Government Accountability Office. At 38 percent of the $1.25 billion total for all of the 10 involved agencies, this is by far the most moneysought by any of the agencies.

Durbin criticized Republicans for holding up Cordray’s confirmation, saying his conservative colleagues “should stop doing the bidding of the financial institutions afraid of oversight and stand on the side of families and small businesses across America.”

Shelby – the most powerful Republican on the banking committee – is willing to sacrifice the consumer bureau’s goals to ensure the agency operates safely and soundly, said Cato’s Calabria, who previously worked with Shelby in the Senate.

While it has an uncertain future without a director – along with the fact that one of the financial reform law’s architects, former Sen. Chris Dodd, D-Conn., has retired and the other, Rep. Barney Frank, D-Mass., will be out of Congress after next year – the bureau continues to work on behalf of consumers in the face of criticism as another regulator.

For more information on the Consumer Financial Protection Bureau, visit consumerfinance.gov.