WASHINGTON — Concerned that the ballooning national debt could hurt the U.S. even more in the next decade, Sen. Bob Corker, Republican from Tennessee, on Tuesday called his colleagues in Congress “unbelievably irresponsible” for not doing more to tackle the most severe challenges faced by the nation’s economy.

Corker, a former businessman in construction and real estate industries who currently serves on multiple committees in the Senate, said with excessive debt and governmental overregulation, America’s free enterprise is at severe risk.

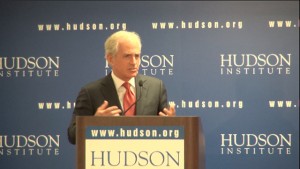

“As a nation, we are one fiscal reform away,” Corker said during a discussion Tuesday at Hudson Institute.

The reform, Corker said, is a combination of a pro-growth tax code and a long-term plan to restore the nation’s solvency to entitlement programs such as Social Security and Medicare.

Without detailing his actual reform proposal, Corker, who is trying to win a second term in this fall’s election, pointed out that while the most important issue now is to reduce the $1.2-trillion deficit, he was upset with Congress’s inability to take action.

Corker has been working on his fiscal proposal for more than seven months, though no legislation has been introduced. He said he is confident Washington is seeing the need for a plan that will help America regain its fiscal power.

“I don’t think there is anybody in the Senate that believe we are really going to have a $5 trillion tax increase at the end of the year,” Corker said, “That will only add uncertainty to our economy.”

Corker said he is hopeful that both aisles of Congress will work together and address the issue in the next six months.

A member of the powerful Senate Committee on Banking, Housing, and Urban Affairs, Corker said he is also concerned about excessive regulations over the financial sector.

Referencing recent scandals in the banking industry, Corker said while the free market system inevitably creates some bad actors, regulators need to consider that only one-third of total financial transactions take place in the regulated market, thus overregulation is not the solution.

“As regulators, we should be more vigilant and make our regulation more transparent,” said Corker, “We need to punish the bad actors, but not for political reasons.”

Corker said his biggest concern in the election year is Congress’s inability to move forward on big-ticket issues such as sequestration, or automatic spending cuts triggered when Congress cannot reach an agreement on spending.

Congress passed the Budget Control Act last August, which requires $1.2-trillion budget cut over the next decade plus a $900-billion discretionary spending. But since a super committee failed to effectively make the cut, as part of the deal, sequestration will have to kick in and cut additional hundreds of billions of dollars from the nation’s defense and social programs.

A strong opponent of sequestration, Corker said with the clock ticking in the election cycle, little time is remaining before it hurts America’s economy.

“This is a very timely question,” said Corker, “The easiest way to deal with sequestration is to come up with a $1.2 trillion package now, not to push it till after November. Congress has been unbelievably irresponsible.”