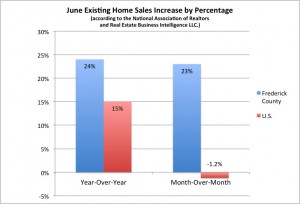

WASHINGTON — June existing-home sales in Frederick County rose at year-over-year and month-over-month rates of roughly 24 percent, crushing the national changes in both categories.

Frederick County’s 343 closed sales in June were a 23-percent rise from the month prior, according to Real Estate Business Intelligence LLC.

The county’s year-over-year spike beat the U.S. increase of 15 percent and toppled the nation’s dip of 1.2 percent from the month of May. Frederick County also bested the Mid-Atlantic region’s year-over-year total-sales increase, which was on par with the national number.

“The Washington metropolitan area has outperformed the U.S. as a whole because of the local economy,” said National Association of Realtors spokesman Walter Molony. “We’ve had reports of median selling times as low as nine days in parts of the area. I think Frederick County is beginning in a similar pattern.”

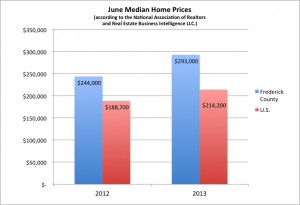

Frederick County houses sold at a median price of $293,000 in June, a 20-percent jump from 2012 and 1.93 percent higher than May.

“I still think the lower price ranges are moving a lot better than the upper price ranges,” said Todd Sampson of Mackintosh Realtors in Frederick. “Anything below ($250,000 to $300,000) is still active. Once you get above ($300,000), it’s still an issue.”

Nationally, median home prices climbed 14 percent from the year prior to reach $214,200 in June. That makes for 16 straight months of year-over-year price increases, according to the National Association of Realtors.

In the Mid-Atlantic region in June, the median home price was $330,000, up 8.2 percent from a year ago and 3.1 percent from May.

Sampson added that demand for high-priced homes has tapered because of recent interest rate hikes. June rates for a 30-year, conventional, fixed-rate mortgage rose from 3.38 percent last year to 4.07 percent this year, the highest they’ve been since October 2011, according to Freddie Mac.

“Affordability conditions remain favorable in most of the country, and we’re still dealing with a large pent-up demand,” said National Association of Realtors Chief Economist Lawrence Yun in a statement. “However, higher mortgage interest rates will bite into high-cost regions of California, Hawaii and the New York City metro area market.”