WASHINGTON– President Donald Trump’s newly released tax plan could send billions of dollars of cash currently held overseas back to the United States.

As noted in the White House statement released Wednesday, the plan “ends the perverse incentive to keep foreign profits offshore” by offering U.S. companies a tax holiday to bring their stockpiles of foreign cash home.

While the Trump administration said it hoped that any return of capital would spur investment, it could also be used to reward stockholders through share buybacks or dividends. Some analysts believed shareholder-friendly actions were more likely.

“There’s no reason to think all this additional overseas capital would go to investment,” said Dean Baker, co-founder of the Center for Economic and Policy Research. “Perhaps in principle, but in practice they’re already investing as much as they want.”

This would not be the first repatriation tax holiday. In 2004, Congress allowed U.S.-based companies to repatriate foreign profits at a 5.25 percent rate with the goal of encouraging domestic capital investment.

“In 2004, despite all the rules, most of that money ended up in shareholders’ pockets,” said Hunter Blair, budget analyst at the Economic Policy Institute.

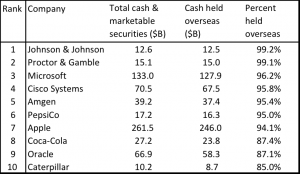

Not all U.S.-based companies would benefit equally. Certain companies hold a significantly higher percentage of their cash and marketable securities overseas in foreign subsidiaries than others. Topping the list of companies in the S&P 500, Johnson & Johnson (NYSE: JNJ) and Proctor & Gamble (NYSE: PG) both held over 99 percent of their cash overseas as of their latest Securities and Exchange Commission filings.

While a repatriation tax rate was not provided, the plan said it was “exempting” repatriated profits, leading some analysts to question if there would be no tax levied at all on the money overseas.

“The language sounds like 0 percent, but I’d be shocked if it ended up that way,” said Baker.

Some analysts worried that regardless of the rate, any repatriation holiday would send the wrong signal to companies stashing profits outside the country.

“Repatriation in 2004 sent a message to companies with cash overseas: Just wait long enough, and eventually Congress will save you,” Blair said.

S&P 500 companies with the highest percentage of their cash held overseas