WASHINGTON- House Speaker Paul Ryan and Minority Leader Nancy Pelosi made it clear Thursday that the Republican tax reform plan is the new battleground for Congress as it moves past the GOP’s failed efforts to pass a health care law, drawing Americans’ attention to possible budget deficits.

Ryan and Pelosi, held separate press conferences to outline their tax visions. Both agree that the tax cut plan should be revenue-neutral – meaning it should not reduce revenue without reducing spending by the same amount. But they differed on how to achieve that goal: Ryan said economic growth will offset lost tax revenue, while Pelosi suggested said spending cuts are needed to offset tax losses.

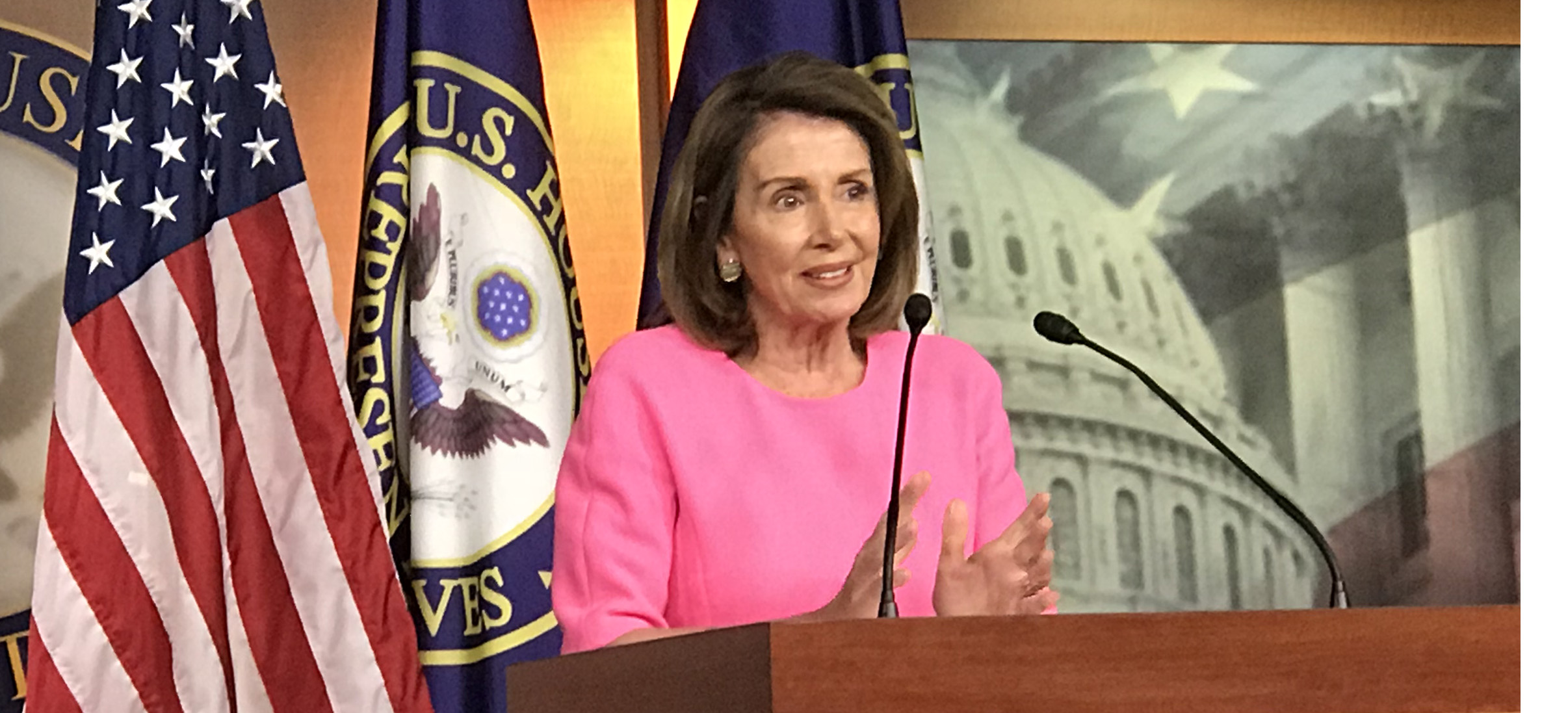

“We on the Democratic side are pay as you go –,you want a tax cut, pay for it,” she said. “You want to make an investment, pay for it so we are not increasing the deficit.”

Under the proposed tax reform framework, corporate tax rates would go from 35 percent to 20 percent, and for small businesses that file as S-corporations, their taxes would go from 39.6 percent to 25 percent.

Tax brackets for individuals would be reduced from seven to three brackets, set at 12 percent, 25 percent and 35 percent.

Ryan said tax reform legislation should abide by the Byrd Rule,” which allows the Senate to block any bill that would increase deficit by a significant amount.

“We think (lower tax) rates are a critical thing for growth and international competitiveness,” he said. “We wanted to make sure we had a middle-class tax cut and so you just can’t do everything you want to do.”

He expects that the House Ways and Means Committee and the Finance Committee will work out the specifics of the bill, adding “there are many different way of doing it.”

“The purpose of our tax plan is to help the middle-class, to help get jobs created, and to help keep business in America,” said Ryan.

Pelosi said she hopes that some Democratic ideas will be incorporated into the bill.

“We want growth, we want good paying jobs, we want to reduce the deficit, so …that’s what we have common ground on,” she said.