WASHINGTON — House Minority Leader Nancy Pelosi skewered the proposed GOP tax bill Tuesday for its proposal to eliminate interest deductions for student loans, part of a constant attack on the $1.7 billion measure since it was unveiled last week.

“The bill would crush a generation of graduates under a mountain of debt, casting a long shadow over their future,” said Pelosi.

The bill, which is being finalized by a House committee this week, includes a proposed repeal of a student loan interest deduction that allows those who are eligible to save up to $625 in taxes. In 2015, over 12 million people used the student loan interest deduction.

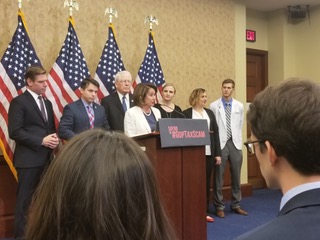

Pelosi was joined by Democratic Reps. David Price of North Carolina, Eric Swalwell of California and Brendan Boyle of Pennsylvania along with students and their advocates to criticize the bill for shifting the burden of debt to the middle class and a generation of college students.

“It is wrong,” Boyle said, speaking from a podium adorned with a sign that read “Say no to #GOPTaxScam in red letters,

,“It is Robin Hood in reverse,” he said. We must fight back.”

George Washington University medical school student Max Ruben said the student loan interest deduction is important to him and his fellow students.

“I am going to be in approximately $300,000 worth of debt by the end of my medical school tenure,” Ruben said. “I’m here today to ask that Congress not eliminate the tax deduction for interest payments on student loans.”

Swalwell said that he, too, had used the program to pay for college and still owes just under $100,000.

“I rent in the community where I grew up,” Swalwell said, “hoping that I can come out of the student loan debt and one day and eventually buy with my wife and our son.”

He also announced the Democrats plan to roll out a higher education plan that would include raising the student loan interest deduction from $2,500 to $5,000 and lifting the income cap.

“It’s an incredibly important program,” said Maggie Thompson, executive director of Generation Progress, which advocates for millennials.

“That’s just the tip of the iceberg,” Thompson said, “This is about a disinvestment in our generation and the middle class and a transfer of wealth to the already super wealthy.”