WASHINGTON — House and Senate Democrats unveiled an alternative to the Republican tax proposal Wednesday that would nix a corporate tax cut if large corporations fail to reinvest tax savings into wage increases and more hiring.

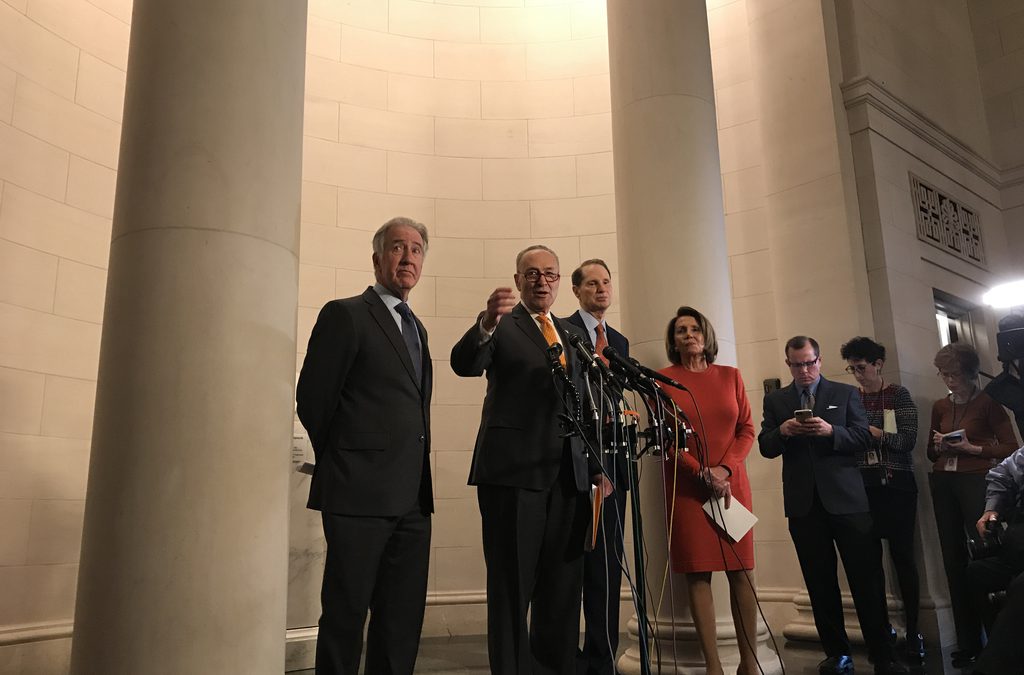

“We say to the Republicans: Put your money where your mouth is,” said Senate Minority Leader Chuck Schumer. “And if your claims that these tax breaks for big corporations will create jobs don’t pan out, take back the tax break – we don’t believe it’s real.”

In the Republican tax proposal introduced Nov. 2, the corporate tax rate would be slashed from 35 percent to 20 percent at a cost of $1 trillion in lost revenue

“The reality is, corporations right now are awash in capital,” said Sen. Ron Wyden, D-Ore. “They have enormous cash hoards on hand. And we want to make it clear that when the consumer, the middle class, is driving 70 percent of the economic activity in our country, they ought to be the focus.

Shortly after the House Ways and Means Committee voted down eight other Democratic amendments along party lines Wednesday, a spokesman for House Majority Leader Kevin McCarthy said McCarthy supports the committee’s decisions, a sign that the amendment unveiled by Democratic leadership is unlikely to succeed.

Schumer said Democrats’ victories in the governor’s races in Virginia and New Jersey on Tuesday were signs that voters aren’t happy with Republican policies.

“The Republicans should look at the elections last night, and it should be a giant stop sign for their tax bill,” he said.

But House Speaker Paul Ryan has insisted the plan helps companies improve competitiveness and offers a break for the working class.

“It levels the playing field for our businesses so they don’t ship jobs overseas anymore,” said Ryan in a statement after the Republican tax plan was released. “It gives hardworking taxpayers in the middle the kind of relief that they need to get ahead – the peace of mind they need so they can plan.”

A report released Wednesday by the Tax Policy Center, part of the Urban Institute and Brookings Institution, found that taxes would be lowered for all income groups in 2018. However, the report also found higher income earners would see the largest decrease in their tax rate, while lower income earners would see the lowest.

According to analysis from the Congressional Budget Office on Tuesday, the GOP bill would increase the budget deficit by $1.7 trillion over the next decade. In order for the GOP tax plan to pass the Senate with a simple majority, the plan’s cost cannot exceed $1.5 trillion under terms of the 2018 budget resolution. Republicans control the Senate 52-48, making it highly unlikely they could get the 60 votes needed to break a filibuster if they violate the budget resolution deficit limit.