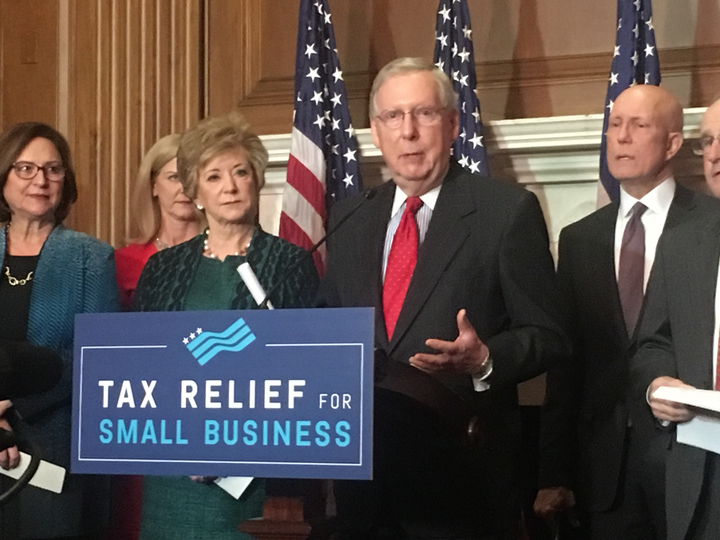

WASHINGTON — The Republican tax plan will pump billions of dollars back into the economy, reinvigorating small businesses and driving growth, Senate Majority Leader Mitch McConnell and other GOP senators said Tuesday in a news conference possibly aimed as much at recalcitrant Republicans as at a wider audience.

“The aim of this entire exercise is to reduce the burden on taxpayers and create an environment that allows families and businesses, particularly small businesses, to thrive,” said Sen. Jim Risch, R-Idaho.

McConnell and others spoke just one day after an announcement from Sen. Steve Daines, R-Mont., that he would not support the GOP tax plan in its current form.

“I want to see changes to the tax cut bill that ensure main street businesses are not put at a competitive disadvantage against large corporations,” Daines said Monday. “Before I can support this bill, this improvement needs to be made.”

Sen. Ron Johnson, R-Wis., previously stated that he opposed the bill for the same reason. After Tuesday’s press conference, however, Johnson was among those who voted to move the tax bill out of committee and to the Senate floor for a vote.

The GOP’s slim 52-vote Senate majority means that more than two Republican defectors would prevent the bill from being passed because no Democrats currently support the bill. In addition to Daines’ objections, a few other senators, including, Sen. Susan Collins, R-Maine, and Sen. Jeff Flake, R-Ariz., have expressed hesitation about supporting the bill.

Democrats Heidi Heitkamp of North Dakota and Joe Manchin of West Virginia, told reporters Tuesday that they are open to voting for a Republican tax bill but that they cannot say definitively until a final version of the bill is created.

At Tuesday’s news conference, senators and leaders of several small businesses associations each promised that the GOP tax plan, which includes large tax cuts that analysts have said favor corporations and wealthy individuals, would enable small businesses to hire more people and earn more money.

“In Iowa alone, tax cuts could create an additional 10,000 jobs,” said Sen. Joni Ernst, R-Iowa.

Many senators also stressed that small business owners in their home states were clamoring for tax cuts. “What I hear from Nebraskans is [that] we need to make some changes in the tax code if they are going to continue to be able to grow,” said Sen. Deb Fischer, R-Neb.

The bill enjoys the support of many small business organizations, including the National Federation of Independent Business and the Small Business and Entrepreneurship Council, whose leaders spoke at the Republican news conference.

However, a poll released Monday by Businesses for Responsible Tax Reform, a group opposed to the GOP tax plan, indicated that only 34 percent of small businesses surveyed support the GOP tax plan.

“All of us have been reading and listening to some negative things about this tax bill,” Risch said. “Today, you’ve heard from a real cross-section of those who are going to work with this bill and what it will do for their businesses.”

Daines has not issued a statement about the reform bill since the press conference and his office did not return a request for comment.

Without any Democratic votes, the tax bill can only withstand two GOP defections — but with Johnson’s apparent support, a fragile Republican coalition could, barring additional defections, ultimately pass the bill.