WASHINGTON – The Commodities Futures Trading Commission’s Global Markets Advisory Committee held a meeting for the first time since the signing of the Dodd-Frank Wall Street Reform. The goal is to figure out how the regulations will affect the global OTC market.

“Friends, Romans, countrymen, lend me your ears,” said Patrick Pearson, head of the financial markets infrastructure of the European Commission, quoting “Julius Caesar.”

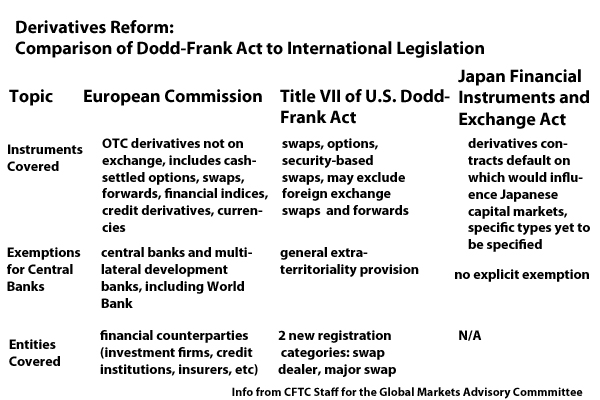

Pearson highlighted the subtle differences between the European legislation and the Dodd-Frank bill, such as the proposition of ownership tax and limits. However, he said that although the starting points may be different, the end point is the same.

“What we’re discussing today is not a small matter, but…an importance to everyone,” he said. “We need a regulatory response because these are issues that require public authority and public leadership.”

Committee members met with top market regulators from Japan and Europe to assess the differences between respective legislation and look for ways to coordinate for the future.

The derivatives market is blamed for the cause of the “flash crash” on May 6 when a single computer-driven sale of E-mini S&P 500 Index futures worth $4.1 billion triggered the Dow Jones Industrial Average to plunge more than 700 points within minutes.

“How we move forward in the U.S. must be consistent with those overseas,” said CFTC chairman Gary Gensler at the meeting Tuesday.

At a conference Monday in Washington, Gensler talked about the flash crash and raised the possibility of more transparency in pre-trading and limits on brokers using computer algorithms.

The OTC market has been under intense scrutiny because it’s difficult to govern, though regulators have been trying to do just that. The CFTC voted at an initial hearing Friday in favor of new rules that would put a ceiling on banks and major swap users to own no more than 20 percent of derivatives clearinghouses, exchanges and trading systems.

Concern among analysts is that the new law, enacted in July, will run the risk of overregulation. The greatest fear is that more rules would push market liquidity overseas, where regulations aren’t as stringent as they are in the U.S.

Europe has one of the most developed derivatives market, and is similar to the U.S. market in clearing and clearing mandates, according to Craig Pirrong, a professor of finance at the University of Houston and a well-known derivative expert. “The big difference…is that Europe has not gone to the point of mandating swap-execution facilities. The constraints on how one can execute [a trade] are going to be a major determinant to where people do business.”

Swap-execution facilities, or SEF, are electronic trading systems where users can accept or bid on multiple quotes by multiple participants.

“One [concern of the financial bill] is that in an attempt to reduce systemic risk, [it] might have created a new one,” said Pirrong. “It can create a false sense of security that we’ve addressed in OTC derivatives.”

Pirrong points out that centralized clearing through SEF or exchanges may not be the most beneficial since bi-lateral trading can create more custom contracts, instead of a one-size-fits-all approach.

Having passed new legislation in May, the Japanese derivatives market isn’t as developed as that of U.S. or Europe, but is one of the largest in Asia. Its legislation includes more transparency of the settlement of OTC transactions, such as a mandatory clearing counterparty, also known as CCP, a clearing house often operated by major banks to facility trading in derivatives and equities markets.

“We are converging, we are not competing,” Pearson said. “We’re looking as closely as the SEC and CFTC are to rules to ensure that there is consistency. This is a global market and it needs a global response.”