WASHINGTON — The U.S. government has an addiction with spending money, and it doesn’t seem to be getting better anytime soon.

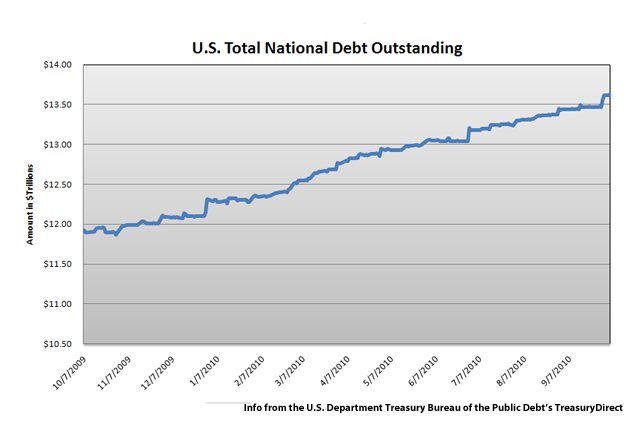

The current national debt, as calculated by the Treasury as a summation of debt held by the public and intergovernmental holdings, is at approximately $13.6 trillion, up 14 percent from a year ago at $11.9 trillion. Analysts say that number will continue to increase faster than revenue, and probably not in the most ideal way.

Facing a grim outlook even as the economy recovers, there are possible solutions to alleviate the consequences, said Donald Marron, director of the Urban-Brookings Tax Policy Center, at a gathering Thursday of the National Economics Club on raising revenue.

He highlighted a few ways to raise additional revenue with the least potential economic harm:

•Real economic growth: If the economy grew by one percent, it would raise about $2.5 trillion in extra revenue, according to data from the Congressional Budget Office. However, this would also mean that the government would need to spend approximately $3 trillion, creating a negative net effect. In response, Marron suggested two possibilities in increasing real economic growth. First, encourage people to work longer, extending productivity and output. Next, encourage immigration of higher-skilled laborers, who will contribute to the economy through taxes, thus growing the economy.

•Ratcheting down tax expenditures: Not all tax expenditures are the same, Marron said. He said expenditures such as mortgage interest reductions, that encourage people to carry greater mortgages and debt, are fundamentally skewed. Reducing tax expenditures would be a gentler way of increasing revenue.

•Tax the bad first: By focusing on pollution or carbon taxes, the government can essentially hit two birds with one stone. Under a cap and trade approach, the government can be too willing to give away permits or credits. He describes cap and trade permits to gambling chips at a casino – people are more willing to give away credits because they aren’t in the form of real cash. The alternative is carbon taxes, which would then encourage the competitiveness of non-carbon technology thus developing better research and development.

After these steps, Marron suggested a reevaluation of the debt situation. If the three steps don’t help the situation, there is a final solution:

•VAT possibility: Out of the countries in the Organisation for Economic Cooperation, the U.S. is the only one that does not have a federal consumption tax. Marron noted that although VAT is a taboo, the U.S. should consider a creative alternative like Canada’s Goods and Services tax, a standard federal tax based on consumption but essentially functions the same as a VAT.

While it’s important to see how the government should raise money, it’s equally important to understand the other side of the equation – cut back on spending.

“What we know is that in debt markets, they don’t respond gradually,” said Kent Smetters, a professor of insurance and risk management at the Wharton School and former deputy assistant secretary at the Treasury. “They tend to snap. It’s like a sleeping giant. All of a sudden, it awakens, and everyone panics.”

Although great, the $13.6 trillion doesn’t completely recognize the weight of the nation’s debt problem, according to Smetters. He estimates that if national debt included all implied debt – present value shortfalls such as social security and Medicare – the number would be close to an excess of $80 trillion.

“Those are the things that make me the most nervous,” Smetters said.