WASHINGTON — Despite the last-minute deal to lift the debt ceiling, the prospect of the United States losing its triple-A credit rating is still keeping Beijing and Hong Kong up at night.

A possible downgrade is a difficult situation for China, said Diane Swonk, chief economist at Chicago-based financial services firm Mesirow Financial Holdings Inc. Swonk believes a downgrade of the U.S. credit rating is “still up for grabs” and Treasury Secretary Timothy Geithner said as much Tuesday morning in an ABC interview.

Geithner said global confidence in the United States is “very damaged” by the protracted negotiations in Washington.

On Tuesday, as the Senate neared a vote on the debt deal hammered out over the weekend, the dollar index, which compares the U.S. currency against a basket of six currencies including the Swiss franc, the euro and the yen, was trading at 74.42, up from 74.25 late Monday. The index is almost flat compared to a month ago.

“It’ll be interesting to see if this in any way forces China to rethink its currency regime, and I think it has to be a pretty dramatic move,” Swonk said.

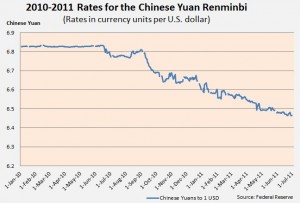

Currently both Hong Kong dollar and China’s yuan are pegged to the dollar. Although Beijing is trying to maintain a loose peg for the yuan, any sudden drop in the dollar impacts the stability of its currency.

Meantime, Chinese market participants are feeling uneasy about the possible downgrade and the weak dollar.

Ben Kwong, Hong Kong-based chief operating officer at investment firm KGI Asia, said if the U.S. debt concern persists and the dollar remains weak, U.S. interest rates could face upward pressure as Treasury bill investors demand higher compensation for the declining value of their assets.

If U.S. interest rates climb, Hong Kong would have to follow, as Hong Kong Monetary Authority normally follows in step with any interest rate action taken by the U.S. Federal Reserve.

“Investors definitely do not welcome that,” Kwong said.

Peter Lai, director at DBS Vickers Securities in Hong Kong, also saw few winners amid a U.S. downgrade.

“A downgraded rating will affect the global economy as a whole, but may be beneficial to a few countries like Singapore, who has a triple-A rating,” Lai said. “Many nations will shift their investment to these countries’ currency.”

Chinese exports in focus

Exports are another concern for China stemming from the possible downgrade and weak dollar.

A U.S. downgrade could hurt the global economy, which would lead to weaker demand for China’s exported goods, Kwong said. If the yuan appreciates as a response to the weak dollar, it will further erode the competitiveness of China’s exported by making production costs higher, he added.

But Paul Wachtel, professor of economics at New York University, remains positive about China’s strong manufacturing economy.

“Even with substantial appreciation of the Chinese currency, the power of Chinese manufacturing is not going to go away. China’s ability to export to the rest of the world has been built up to an enormous position of strength, which is not disappearing,” Wachtel said.

Wachtel also added that the bigger effect of appreciation of the yuan and a fiscal adjustment in the United States is that China will begin to shift its emphasis from export growth to domestic consumption by the public.

Plus, it is still hard to break the export-import ties between China and the United States.

“The problems are that we were addicted to consumption and China was the only one to feed that addiction. Unwinding that addiction is not an easy thing,” Swonk said.