WASHINGTON — Retail investors’ bullish sentiment jumped to July levels in the past week, but the portion of investors expecting stocks to fall suggests markets have yet to hit a bottom.

“Right now we have a tug of war,” said Richard Ross, global technical strategist at Auerbach Grayson & Co. “Sentiment numbers to me are at equilibrium. It’s almost counterintuitive — a fierce war with both sides tugging, but we’re not making much progress.”

The American Association of Individual Investors’ weekly online poll released Thursday found 39.8 percent of surveyed members reported they were bullish on the stock market over the next six months.

Bulls? Bears?

When finance professionals use these terms, they’re not talking about sports teams. Here’s a glossary of common investment terms.

Bull: An “optimistic” investor who thinks the markets will rise in value. Bulls buy stocks when they believe prices are low. If they’re correct, bulls profit by selling off the stocks at the predicted higher prices.

Bear: A “pessimistic” investor who think the markets will fall in value. Bears sell stocks when they believe current prices are high. If they’re correct, bears profit by buying back the stocks at the predicted lower prices.

Contrarian: An investor who does the opposite of everyone else. A contrarian buys stocks that others are selling and sells those that others are buying.

Asset: Any resource expected to increase in value over time. Individuals, companies and nations can own assets, which include stocks, bonds and bank deposits.

Equity: The ownership or value of an asset after all debts associated with it are paid off. Investors can have equity in assets ranging from stocks to homes and cars.

Security: Another word for a stock, bond or other asset that has value and can be traded.

Derivative: A type of security whose value is “derived” from the performance of a traditional security such as an asset or market index like the S&P 500.

Future: A derivative allowing the buyer and seller to trade an asset at a negotiated future price and date.

Option: A derivative granting the buyer the right, but not the obligation, to buy or sell an asset at an agreed price on a specific date or during a certain period of time.

Long: To “buy” a stock, bond or other asset.

Short: To “sell” a stock, bond or other asset.

Rally: A period of sustained price increases in the markets. A rally can occur with stocks, bonds and market indexes like the Dow Jones Industrial Average.

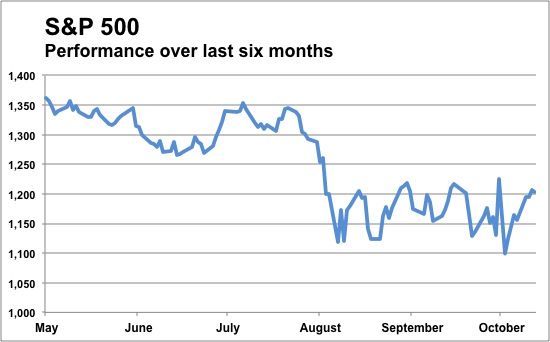

Despite the rally after the S&P 500 hit a low on Oct. 3, some analysts still expect markets to bottom.

It was the first time in 12 weeks the bullish readings in the AAII survey have risen above the historical average of 39 percent, and marked an increase of 4.5 percentage points from a week ago. Optimism is running at the highest since July 21, just before stocks set off on a losing stretch and headed into sharp August and September declines.

The survey found bearish sentiment fell to 36.4 percent from 45.7 percent last week, the lowest since early September.

The rally that started Oct. 4 “is giving individual investors some optimism stocks will rise, but many are concerned we could still see a drop in prices,” said Charles Rotblut, editor of the AAII Journal.

The S&P 500 closed at a more than one-year low on Oct 3, and then rallied back nearly 10 percent on optimism European leaders would come up with a plan to avoid a Greek default. It closed Thursday with a 0.3 percent loss at 1,204.

Analysts that look to sentiment indicators for market timing signals note that stocks are often primed to rebound when bearish sentiment reaches very high levels. Likewise, high levels of bullishness can correspond to bottoms in the market.

For instance, as stocks were bottoming in early March 2009, bullish levels were under 20 percent. Bearishness had topped 70 percent.

Recent readings aren’t broadcasting such a clear sign, perhaps reflecting investors’ own lack of conviction about the next year. The gap between the bulls and bears in the AAII poll, at a relatively narrow 3.4 percent, suggests to Ross the markets are experiencing “extraordinary volatility.”

Other sentiment readers are flashing more optimistic signs.

The Investors Intelligence Advisors Sentiment Index, which surveys the authors of about 150 stock advice newsletters, released results Wednesday showing bullish sentiment remained at 34.4 percent for the second straight week. The percentage of investors feeling bearish edged higher to 46.3 percent from 45.2 percent last week.

This is the highest bearish reading in the IIAS Index since the 2008-2009 bear market low.

“People are making negative bets on the market,” said John Gray, an editor at Investors Intelligence stock research service. “When there are high levels of pessimism, it suggests the markets are at or near the bottom.”

Mark Arbeter, chief technical strategist at S&P Capital IQ, thinks the rally that began last week will run into trouble.

“One of the reasons we think stocks could pull back in the near term is that we think the U.S. Dollar Index is close to bottoming,” Arbeter said in an email.

Auerbach’s Ross also cited the U.S. dollar as one of the key indicators to watch as investors wait for a reversal in the markets.

The dollar index has fallen 1.9 percent this month as stocks have rebounded. The dollar gauge gained 5.7 percent in the third quarter.

On Thursday, the Dow Jones Industrial Average ended down 41 points at 11,478. The Nasdaq Composite gained 16 points to 2,620.