Isabella Zhong/MEDILL Federal Reserve Governor Ben Bernanke delivered his semi-annual monetary policy report to the House Financial Services Committee Wednesday.

Ben Bernanke signaled that the Federal Reserve will continue to maintain low interest rates, but he did not give any clear hints about whether or not the country’s central bank will be scaling back its bond-buying program later this year.

Delivering his semi-annual monetary policy report to the Housing Financial Services Committee Wednesday, the Fed’s chairman said, “I emphasize that, because our asset purchases depend on economic and financial developments, they are by no means on a preset course.”

Bernanke added that “if economic conditions were to improve faster than expected” then “the pace of asset purchases could be reduced somewhat more quickly.” But he stressed that if unemployment and financial conditions were to become less favorable then “the current pace of purchases [of bonds] could be maintained for longer.”

However, Bernanke was considerably less equivocal about how the Federal Open Market Committee – which oversees the implementation of monetary policy – views interest rates. “A highly accommodative monetary policy will remain appropriate for the foreseeable future,” he said. Right now, the target federal funds rate is set at between 0 and 0.25 percent.

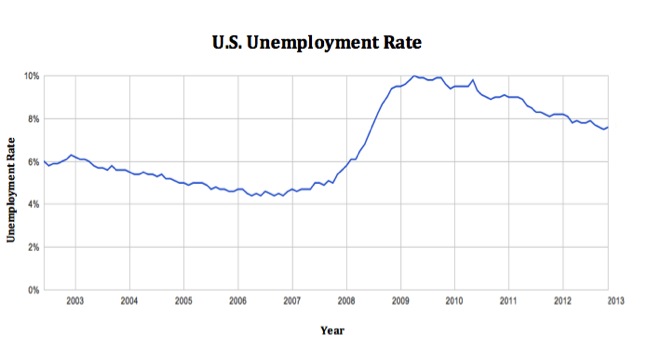

“In particular, the Committee anticipates that its current exceptionally low target range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above six-and-a-half percent and inflation expectations remain well behaved,” said Bernanke.

The country’s jobless rate stands at 7.6 percent. Although the situation has improved significantly since unemployment peaked at 10 percent in October 2009, the road to recovery has been long and shaky. Since March, the unemployment rate has hovered in the 7.5 percent to 7.6 percent range.

Last month the unemployment rate remained unchanged at 7.6 percent. In May, it increased by 0.1 percent.

“Despite these gains, the jobs situation is far from satisfactory, as the unemployment rate remains well above its longer-run normal level, and rates of underemployment and long-term unemployment are still much too high,” said Bernanke.

In addition to keeping joblessness in check, the Fed is also required by law to ensure price stability in the economy by controlling inflation within a certain threshold. Right now, that threshold is 2.5 percent. With the consumer price index increasing only 1.8 percent during the past 12 months, inflation is unlikely to be a big issue for the Fed in the near future.

In fact, Bernanke expressed concern that the nation’s low inflation rate could potentially have a negative effect on economic activity by suppressing capital investment. In other words, a small rise in inflation might be a good thing, according to the Fed. “We will monitor this situation closely as well, and we will act as needed to ensure that inflation moves back toward our 2 percent objective over time,” Bernanke said.

Commenting on the economic projections by the open market committee at its meeting last month, Bernanke said the panel expects gross domestic product growth to reach “between 2.9 percent and 3.6 percent in 2015” and “the unemployment rate to decline to between 5.8 and 6.2 percent by the final quarter of 2015.”

However, he stressed that the economy “remains vulnerable to unanticipated shocks.” He pointed to tight federal fiscal policy and an unexpected slowdown in global economic growth as risk factors. Last week, the International Monetary Fund cut back its forecast for global growth next year by 0.2 percent based on concerns of weaker economic conditions in key developing countries, such as Brazil and China.

And Bernanke reminded, “the specific numbers for unemployment and inflation in the guidance are thresholds, not triggers – reaching one of the thresholds would not automatically result in an increase in the federal funds rate target.”