WASHINGTON — This week not only will the Federal Open Markets Committee convene for its monetary policy meeting but also a number of important economic indicators will be released: consumer confidence, unemployment and gross domestic product. Here’s a rundown of what to look out for.

Fed could strengthen its pledge to keep low interest rates low

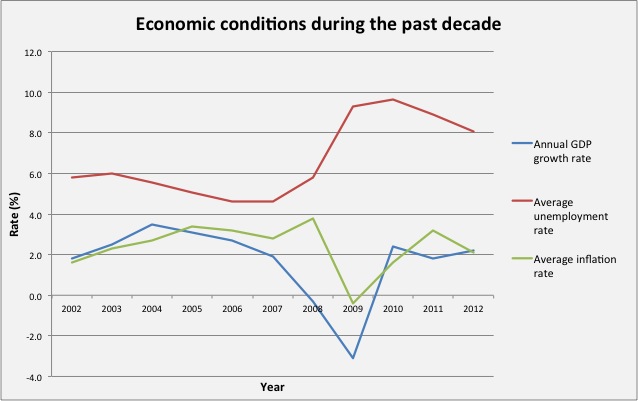

Interactive chart: The Federal Reserve aggressively cut benchmark interest rates in 2008, during the height of the global financial crisis. The federal funds rate has remained at 0 to 0.25 percent since Dec. 2008.

The forward guidance is likely to be a key focal point when the FOMC meets Tuesday for its monetary policy meeting.

There have been suggestions that the committee could be making changes to the thresholds that guide the timing of increases to benchmark interest rates — i.e. the federal funds rate and the federal discount rate — at its July 30-31 meeting. The rates are known as benchmark interest rates because they dictate the cost of borrowing for individual businesses and households in this country.

A Wall Street Journal article said that Federal Reserve officials are considering decreasing the threshold for the unemployment rate and introducing a lower band for inflation, at “perhaps 1.5 percent.” The article’s author, Jon Hilsenrath, is a “known Fed insider” who often moves markets with his commentary on the central bank’s policies.

This potential move by the Fed to revamp its forward guidance would add strength to its pledge to keep interest rates low. In his latest semi-annual monetary policy report to Congress, Fed Chairman Ben Bernanke said, “a highly accommodative monetary policy will remain appropriate for the foreseeable future.”

The introduction of a lower band for inflation would mean that the Fed would refrain from making any upward adjustments to interest rates if inflation remained below that threshold. According to Bernanke, a moderate level of inflation is necessary to support economic growth. “Very low inflation poses risks to economic performance and increases the risk of outright deflation,” he said.

Lowering the threshold for the unemployment rate, which is currently set at 6.5 percent, means that the job market will need to show a greater degree of improvement before the Fed will consider lifting interest rates.

In June, the nation’s unemployment rate was gauged at 7.6 percent, while inflation came in at 1.8 percent on a year-to-year basis.

Even though it has fueled immense speculation in financial markets, it is unlikely that the Federal Open Markets Committee will set a date this week for unwinding its $85-billion-a-month asset-purchase program.

In his monetary policy report, Bernanke said, “I emphasize that, because our asset purchases depend on economic and financial developments, they are by no means on a preset course.”

In 2008, unemployment rose sharply and economic growth plummeted. That prompted the Fed to dramatically cut back benchmark interest rates.

Increased optimism among households

Economists expect the July reading for the Consumer Board Confidence Index, which will be released Tuesday, to come in at 81.6, up slightly from 81.4 in June.

The CBCI, which is based on a survey of 5000 households across the country, is a monthly gauge of how upbeat consumers are feeling about current and future economic conditions.

However, the forecasted increase is muted in comparison with the strong upward momentum that consumer confidence has been showing during recent months. In June, the index added a hefty 7.1 points to the reading of 74.3 points for May.

A similar indicator, the University of Michigan Consumer Sentiment Index, which also measures households’ perceptions of current and future economic conditions, increased to 85.1 in July, from 83.9 in June. The reading, which was released last Friday, is the highest in six years and greatly exceeded its forecast of 84.2.

This upbeat sentiment stands out against the backdrop of surging gas prices and higher mortgage interest rates, which are supposed to dampen the mood among consumers.

Dip in economic growth

The advanced reading for the country’s second-quarter gross domestic product will be released Wednesday. Economists estimated a growth rate of 1.1 percent, which was lower than the actual rate for the first quarter.

In the first-three months of the year, GDP increased by 1.8 percent. That was mainly driven by a 2.6 percent rise in consumer spending. Consumer spending makes up more than two-thirds of U.S. GDP.

Recently, there have been signs of general weakness in the broader global economy. The International Monetary Fund cut back its forecast for world economic growth in 2013 earlier this month to 3.1 percent from an earlier estimate of 3.3 percent.

China, the world’ second-largest economy and the nation’s top trading partner, saw a pullback its GDP growth rate for the previous quarter, while the economic output in the Eurozone contracted by 0.3 percent in the first quarter.

The preliminary reading for second-quarter GDP will be released Aug. 29.

Slightly lower unemployment, but weaker job creation

July’s employment report, which will be released Thursday, is expected to be in somewhat better shape compared with that of the two previous months.

Economists expect the unemployment rate to retreat back to 7.5 percent after it rose to 7.6 percent in May and remained flat last month. The jobless rate is measured through a survey of 60,000 households and represents the percentage of the adult population that is unemployed and actively seeking employment.

Job creation is expected to be weaker in July than in June, when 195,000 jobs were added to the economy. However, the estimate of 175,000 new jobs for this month is on par with the figure recorded in May. The number of new jobs added to economy is gauged through a federal survey of 375,000 businesses.

Despite the recent stagnation in the pace of the job market’s recovery, the situation is noticeably better than in 2012. Job creation for the first half of the year averaged 202,000 per month, up from 180,000 for the second half of 2012. Last month’s unemployment rate is also considerably lower than a year ago, when joblessness stood at 8.2 percent.

Looking forward, the Fed expects unemployment to drop to 6.4 percent, its current threshold for prompting a potential lifting of interest rates, by the end of next year.