WASHINGTON — Although college tuition rose this year by the smallest percentage in 30 years, its crippling cost still deters too many young Americans from pursuing a higher education degree that could eventually land them a lucrative job, finance and education experts said Wednesday.

“We saw yesterday reported that the pace of tuition going up has decreased some, which is encouraging, but still the cost of college is wildly unaffordable for far too many,” said U.S. Secretary of Education Arne Duncan of the College Board’s annual report on college prices.

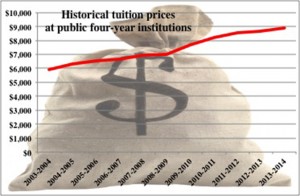

The 2.9 percent increase in in-state tuition and fees at public four-year institutions in 2013-2014 was the smallest percentage increase in over 3 decades. Still, experts say costs are too high and discourage young students from pursuing higher education. Data source: College Board.

At a meeting of the Financial Literacy and Education Commission, Education and Treasury department leaders called for a nationwide focus on financial literacy education. They also called for a new rating system for universities based on their efforts to increase access to affordable higher education—which over time would boost the economy.

“Americans with education beyond high school tend to have higher salaries and contribute to the economy,” said Treasury Secretary Jacob Lew.

College increases the likelihood of upward income mobility by more than 75 percent, Lew said, and college graduates earn more than twice as much as those without a high school degree.

The proposed college rating system, Duncan said, would focus on outcomes at universities, including job placement and loan repayment assistance. The idea is to encourage college attendance among students who otherwise could be discouraged by high costs.

Specifics of the system have not been ironed out yet, and Duncan said that the Education Department “will do a lot of listening over the next few months.”

The rating system “will measure schools according to the value they provide students so families and students can make the most of their money,” Lew said.

Average tuition at a public four-year institution has increased 250 percent over the past 30 years, Lew said, but incomes for families grew an average of 16 percent during the same period..

Furthermore, tuition prices outpace inflation. According to the College Board, average tuition and fees at public four-year institutions increased by 19 percent beyond the rate of inflation over the five years from 2003-04 to 2008-09, and by another 27 percent between 2008-09 and 2013-14.

Richard Cordray, director of the Consumer Financial Protection Bureau, said standardized financial literacy education should be integrated into school curriculum nationwide.

“We believe this education should begin at a young age and continue through graduation,” he said, so that young Americans can better understand the details of the loans they take out and what repayment will be like.

According to the National Conference of State Legislators, 32 states had legislation introduced or pending this year relating to financial literacy or financial education.