WASHINGTON — Former Federal Reserve Chairman Alan Greenspan warned on Wednesday that markets will get another “taper tantrum” when the Fed raises near-zero interest rates.

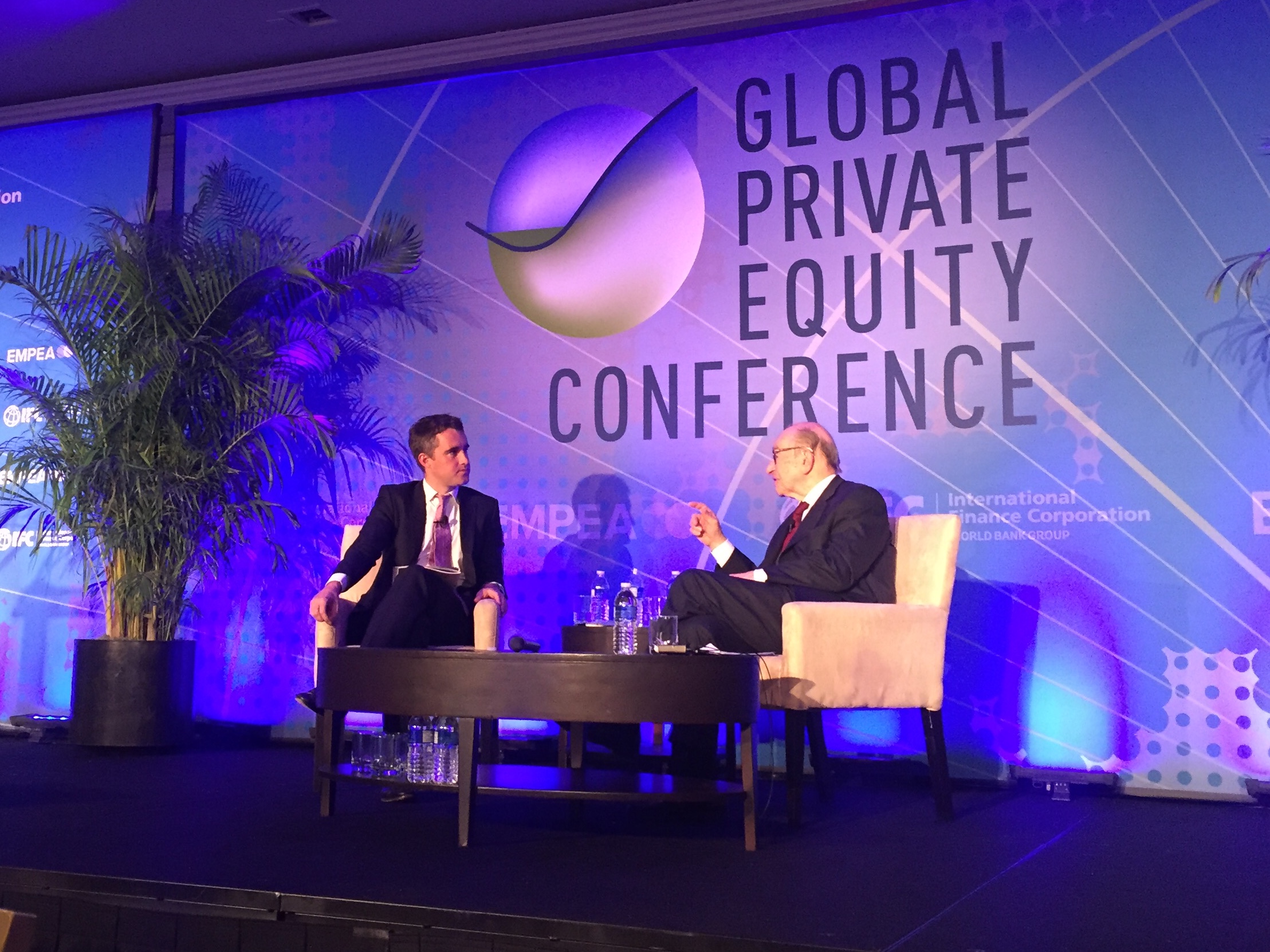

“Just remember we had the taper tantrum. And we are going to get another one,” said Greenspan to a room of 400 people at the Global Private Equity Conference in Washington.

In May 2013, when the Fed announced it would slowdown its bond purchasing program, also known as quantitative easing, the market experienced a shock.

“(Interest rates) normalization is great, but the process of getting there is going to be very rocky,” the former Fed chief said.

Regarding current low interest rates, Greenspan compared it with Greece’s interest rates in the 5th Century BC. “We get interest rates that are not terribly different,” Greenspan said.

Greenspan opined that the lack of productivity growth was a problem of the slower-than-expected U.S. economic recovery. In the first quarter of 2015, real U.S. GDP grew at an annual rate of only 0.2 percent.

“It’s not that we’ve improved. We’ve gotten less worse,” Greenspan said.

Greenspan also shared his thoughts on investment to private equity fund managers. “The best strategy for equity investment has always been: Buy and hold and forget it,” he said. “Once you start to try and trade the market – I don’t care how good you are, how smart you are – You will not beat an index fund.”

“Remember, you are not just buying good stocks,” the 89-year-old economist said, “you are buying stocks, which you think are better than somebody else’s.”

When asked about his views on emerging economies, Greenspan said the BRICS countries “no longer share many characteristics.”

“The double-digit gains of China are over,” Greenspan said. However, he suggested looking at China’s living standard rather than its GDP numbers.