WASHINGTON – With many presidential candidates pushing the idea of debt-free college to the forefront of a national debate, a quieter conversation is taking place in the background: what to do for those who are already deep in student loan debt.

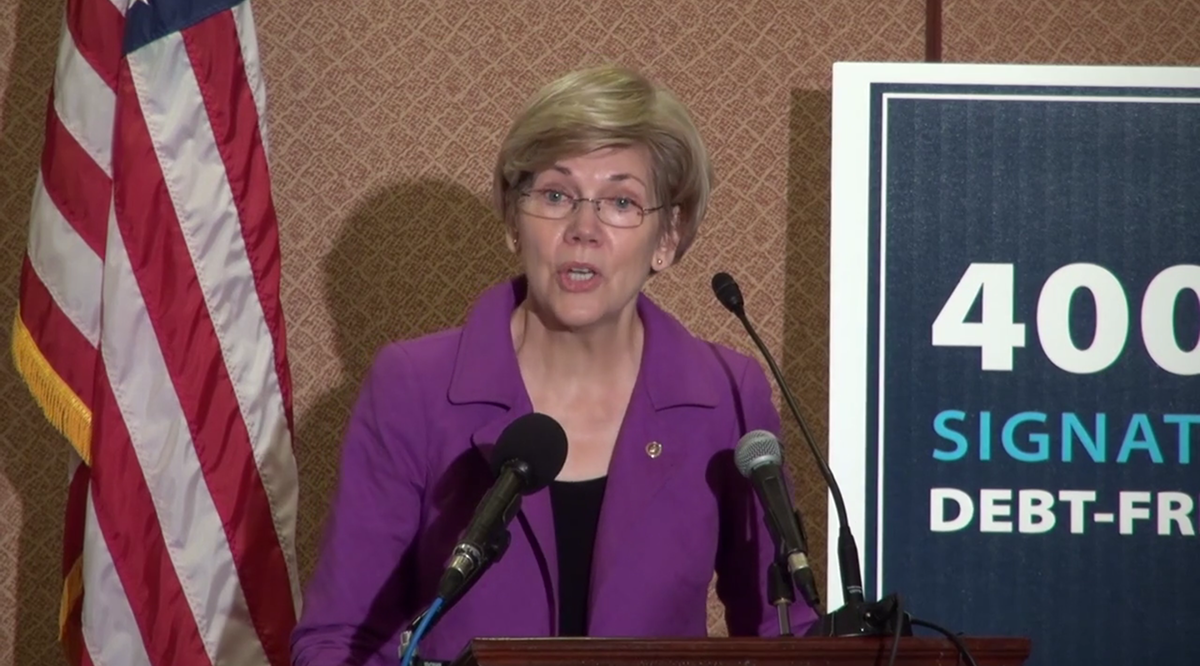

At an announcement Wednesday at the U.S. Capitol about a new resolution supporting debt-free college, lawmakers spent most of their time addressing questions about students who are already struggling to pay back their student loans.

Today more than 40 million people have outstanding student loan debt, according to credit bureau Experian. The total student loan debt in the U.S. is now $1.2 trillion with the average undergraduate student’s loans totaling about $29,000.

“We’ve got to do something about the kids who’ve already been saddled with all this debt,” said Rep. Keith Ellison, D-Minn.

Congress is considering a measure that would allow borrowers with high interest rates on their public and private student loan debt to refinance at last year’s lower rates. A similar bill failed to get support in the last session of Congress.

Many borrowers have outstanding student loans with interest rates around 7 percent for undergraduate loans, but those who took out undergraduate loans in the 2013-2014 school year pay a rate of 3.86 percent under legislation that Congress passed in 2013.

Kristina McTigue, 25, is a student at the high end of the debt scale. Although she is completing her master’s degree in social work at Washington University in St. Louis with no debt, she already has $110,000 of debt from her undergraduate studies at the University of Maine.

When she graduates McTigue hopes to work in the mental health field helping military veterans. But she is worried that even if she finds a job, she will not be able to make the monthly loan payments.

“Anybody in a type of helping profession, just because the salary tends to be lower, really struggles to make those payments,” she said.

McTigue already has experience with loan payments; she spent two years as a teacher before returning to school, paying $100 a month on her loans.

“When I made those payments it was the bottom of the barrel,” she said.

“College used to be a great equalizer,” said Rep. Raul Grijalva, D-Ariz. “Cost should not be a barrier to attaining a degree. When cost is a barrier to attaining a degree then college is reinforcing the inequality of this country.”

Ellison said that higher interest rates have some benefit.

“We do use money that we make off students to help fund the government,” he said.

However he said there other ways to find that money.