WASHINGTON-Presidential candidate Bernie Sanders introduced a bill Thursday to exempt all but the wealthiest of wealthy Americans from paying estate taxes, saying it would address economic inequality in America.

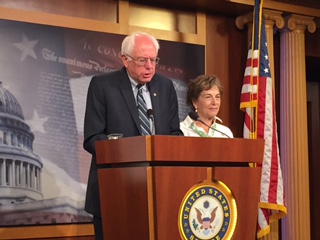

“If we do not make the necessary changes to reduce skyrocketing wealth and income inequality, this country is well on its way towards becoming an oligarchy—a nation owned and controlled by a handful of extraordinarily wealthy and powerful people,” said Sanders, an Independent senator from Vermont, at a news conference.

The bill will only affect a few thousand people in the U.S.

“This legislation would exempt 99.7 percent of Americans from paying any estate tax while ensuring that the wealthiest Americans in our country pay their fair share,” Sanders said.

His campaign said Republicans have passed legislation that provides $269 billion in estate tax breaks to just 5,400 families, with most of the benefits going to families inheriting estates worth more than $20 million.

“Instead of repealing this tax, which makes the very rich even richer, we need to substantially increase the estate tax to make sure that the wealthiest Americans in this country pay their fair share,” Sanders said.

Sanders proposes a 45 percent estate tax for estates worth between $3.5 million (or $7 million for couples) and $10 million, 50 percent for estates worth $10 million to $50 million, and 55 percent for estates worth $50 million or more. Currently, there is a flat 40 percent tax rate for all estates, no matter the value.

About two out of every 1,000 estates will be affected by the increase.

Dan Mitchell, a tax expert at the libertarian Cato Institute, said the bill will not work.

“This is not realistic, in short because the Republicans are in control,” he says. “It’s bad for the economy because it will encourage wealthy taxpayers to stop working as much. Less saving… less entrepreneurship means a less dynamic economy.”

The legislation would end tax breaks for large trusts, and would include a billionaire’s surtax of 10 percent, on top of a progressive rate structure.This would affect only 0.0002 percent of America – or about 650 people. Family farmers would not be affected, Sanders said, because the legislation protects farmland and conservation easements.

“We need to be putting more money into the hands of working families, not the very rich,” Sanders said.