Washington–Five years after the Dodd-Frank Wall Street Reform and Consumer Production Act became law, the Consumer Financial Protection Bureau created under it is once again under fire.

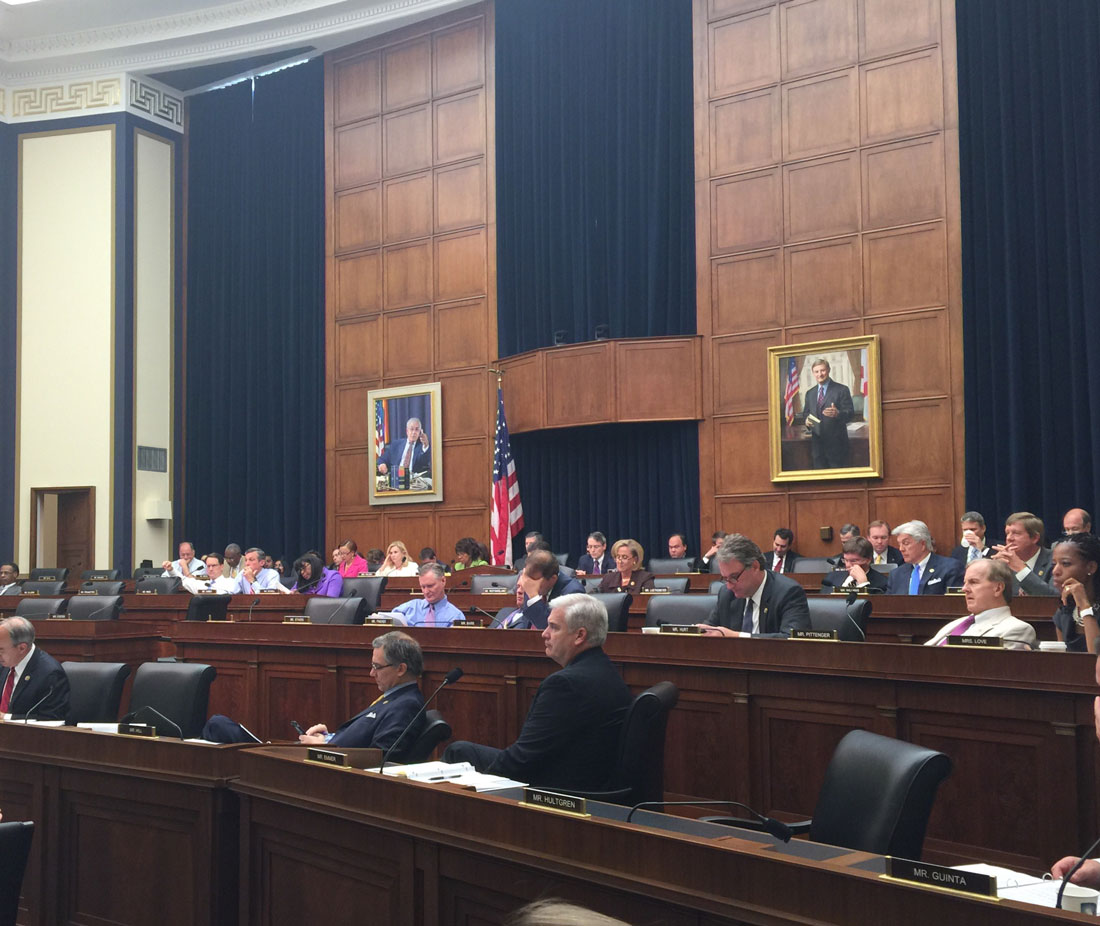

At a House hearing Thursday, academic experts and Republican lawmakers criticized the bureau, questioning the authority it has and the regulatory burden it imposes on consumers across all financial sectors.

International Monetary Fund’s Research Department Director Olivier Blanchard speaks during a press briefing at a hotel in Beijing, China Tuesday, Jan. 20, 2015.

“At the heart of Dodd-Frank was the CFPB, with the ability to regulate virtually every consumer credit product under vague and poorly designed standards.” said Toddy Zywicki, professor and executive director of the Law and Economics Center at the George Mason University of Law.

Zywicki told the House Committee on Financial Services that the bureau has caused “a sweeping amount of damage to American families,” especially with its rules regarding mortgage lending and credit card access.

According to the CFPB’s own estimates, 275 million credit card accounts were closed and $1.7 trillion in credit was eliminated between July 2008 and December 2012.

“And those who bore the harm of this were the lowest-income consumers,” Zywicki said, calling the Dodd-Frank law “a destroyer of free checking to millions of Americans.”

But in a speech Wednesday, Treasury Secretary Jacob Lew praised the law and the CFPB.

“For the first time ever, consumers of financial products have a federal watchdog looking out for them,” Lew said at the Brookings Institution. “And in just a few short years, [the CFPB] brought a noticeable difference for consumers of an array of markets.”

Lew praised the CFPB for its “financial aid shopping list,” launched in 2011 to help students compare and evaluate aid options, the “simpler and easier-to-understand agreements” for credit card borrowers, as well as the tightened requirements that the agency imposes on mortgage servicing operations.

The CFPB has helped consumers by returning “more than $5.3 billion to more than 15 million Americans who have been harmed by violations of consumer protection laws,” he said.

On Thursday, however, Rep. Sean Duffy (R-Wis.) criticized Lew for not admitting that, thanks to Dodd-Frank, banks now have to hold on to more capital and pull out of mortgage lending activities. “These markets are now withering with the way Dodd-Frank regulates,” he said.

“The CFPB, which was tasked to protect consumers of financial products and services from discrimination, ironically, has the worst track record of all government financial agencies of EEO complaints proving the agency is negligent at worst at protecting its own employees from discrimination and retaliation,” Duffy said.

The committee began investigating allegations of discrimination and retaliation against CFPB employees in April 2014. It held a hearing in June regarding new evidence from CFPB employees on the issue.

The Committee will hold two more hearings to further examine the five-year path of the Dodd-Frank law.