Over the past decade, the rapid economic growth, growing wealth, and skyrocketing real estate prices in China have prompted Chinese investors to shop for real estate abroad.

Large companies from China bought prime office buildings and luxury residential buildings in Manhattan and Los Angeles. The shopping style of Chinese individual investors also reflect their deep pockets: they ranked as the biggest foreign buyers of U.S. properties, paying the highest average property prices, and completing about 70 percent of the deals with all cash.

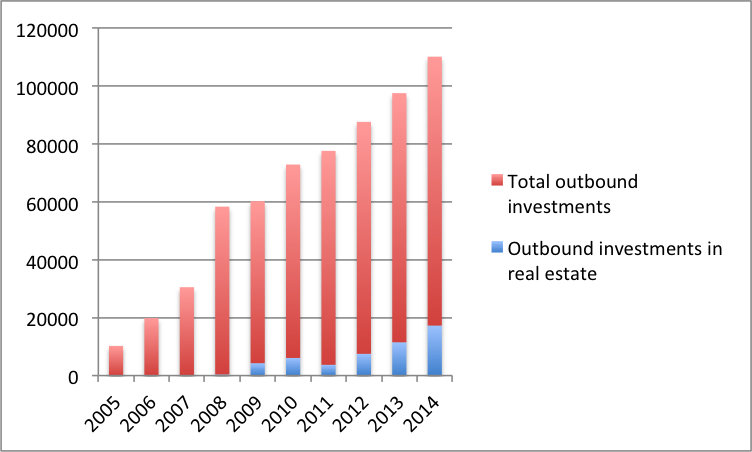

In 2009, China invested in six real estate projects in Britain, Australia, Mauritius and the United States. Total investment in real estate reached $4.28 billion, accounting for 7.65 percent of China’s total outbound investments. In 2014 there were 28 deals in real estate investments, including seven in the U.S. The size of the investments reached $17.27 billion, accounting for 18.6 percent of China’s total outbound investments, according to American Enterprise Institute.

A report by the National Association of Realtors (NAR) said for the first time Chinese buyers became the biggest buyers in terms of unit purchases and dollar volume in the 12 months ending in March 2015. They purchased $28.6 billion worth of property.

Chinese companies buying prime real estate

According to the American Enterprise Institute, Chinese companies started to invest more in real estate markets abroad after the financial crisis. In 2009, China Investment Corporation (CIC), a China’s sovereign wealth fund, invested $2 billion in three U.S. funds focusing on distressed real estate investments.

There are various forms of investment for Chinese companies. Similar to the CIC, the State Administration of Foreign Exchange (SAFE), an administrative agency that manages China’s foreign exchange reserves, invested through a real estate fund. In 2012, Blackstone raised $500 million through the SAFE for its real estate fund.

Other companies bought shares of luxurious properties or developed commercial and residential projects. Soho, China’s largest prime office developer, bought 49 percent share of Park Avenue Plaza in New York for about $570 million in 2011. The following year, Wanke, China’s largest residential real estate developer, co-developed a luxury residential condominium towers in San Francisco with Tishmen Speyer.

Among all the investment, New York, San Francisco and Los Angeles are the top three destinations. There were seven deals in New York including Cassa Hotel at 45th St, One Chase Manhattan Plaza and General Motors Building. Midwest city Chicago also gained attention when Cinda partnered with Zeller Realty Group purchased a 65-story office tower in Chicago in 2014.

Many have compared the Chinese investors with the Japanese investors in the 1980s when they completed high profile deals such as Rockefeller Center in New York and the Pebble Beach Golf Club in California.

However, a Deloitte report said that the Japanese invested when the U.S. property prices were at a peak and they focused on trophy assets and bid aggressively. The Chinese investors increased their U.S. real estate investment when the property prices were recovering after the crisis. “Their investments appear to be focused on reasonably priced properties and those at below market levels,” it said.

Chinese are No.1 foreign buyers in the U.S.

“Chinese buyers are strongly focused on the west coast, which provides geographical proximity, educational opportunities, and business and trade opportunities, for example, Los Angeles, San Francisco, Seattle, as well as New York and Houston,” the NAR report said.

Angela Wong, vice president at Ewing & Associates Sotheby’s International Realty based in Calabasas, California, said, “I think LA, SF and NYC remain the top choice for Chinese investments as safe haven. However, there are more and more Chinese interested to invest in Florida and Texas as they do not have business tax and real estate are far more cheaper.”

She added, good universities, a matured Chinese community, the comfortable climate and the diversified business opportunities are the main reasons that make California a top investing destination.

The United States has seen an increasing number of students from China. According to Project Atlas, which tracks immigration trends of international students studying abroad, there were 274,439 Chinese students studying in the U.S. in 2013, accounting for 31 percent of the total international students. Many Chinese parents purchase houses for their children in the U.S., hoping the value of their properties will appreciate when their children graduate.

The NAR report also said that buyers from China purchased properties that were above the average price and approximately 69 percent of purchases were reported as all cash purchases.

“Sellers favor all cash buyers as they do not have to worry about loan. Buyers have much higher chances to successfully bid on the properties especially in multiple offers situation,” said Wong.

Skyrocketing prices at home

Rising real estate prices and increasing purchasing power have led Chinese companies and individual investors to buy real estate overseas.

After the 1998 housing reform where the Chinese government abandoned the system of linking housing distribution with employment and allowed real estate to be traded in the market. At the same time, Asian’s real estate market was dull after the 1997 Asian Financial Crisis. To encourage domestic consumption, the Chinese government started to invest heavily in real estate market with the hope that real estate would benefit different industries from steel to chemical industry to construction and so on.

According to a 2014 report from Federal Reserve Bank at Kansas, real estate investment has grown at an average annual rate of 20.2 percent since the 1998 housing reform, about twice as high as overall GDP growth. It also said that real estate investment increased steadily from about 4 percent of GDP in 1998 to about 15 percent of GDP in 2013.

Ted Hong, analyst at Regional Investment at CapitalLand Limited, said that high saving rates, relatively low interest in savings, and a lack of diversified investment tools leaves real estate the only investment tool for most of the Chinese investors.

He added that most Chinese residents like owning houses instead of renting, which increases the demands for housings. He also said that housing infrastructure in cities could not catch up with the speed of urbanization in China.

The number of millionaires with assets of more than 10 million RMB had reached 1.05 million in the end of 2012, and the number of super rich with assets of over 100 million, had reached 64,500, according to the Hurun Report, a luxury publishing and events group in China.