WASHINGTON– San Francisco Federal Reserve President John Williams Friday called today’s low interest rates a “warning sign” that the Fed did not fully understand what’s happening in the economy. He also urged Washington to adopt a fiscal policy that would spur growth.

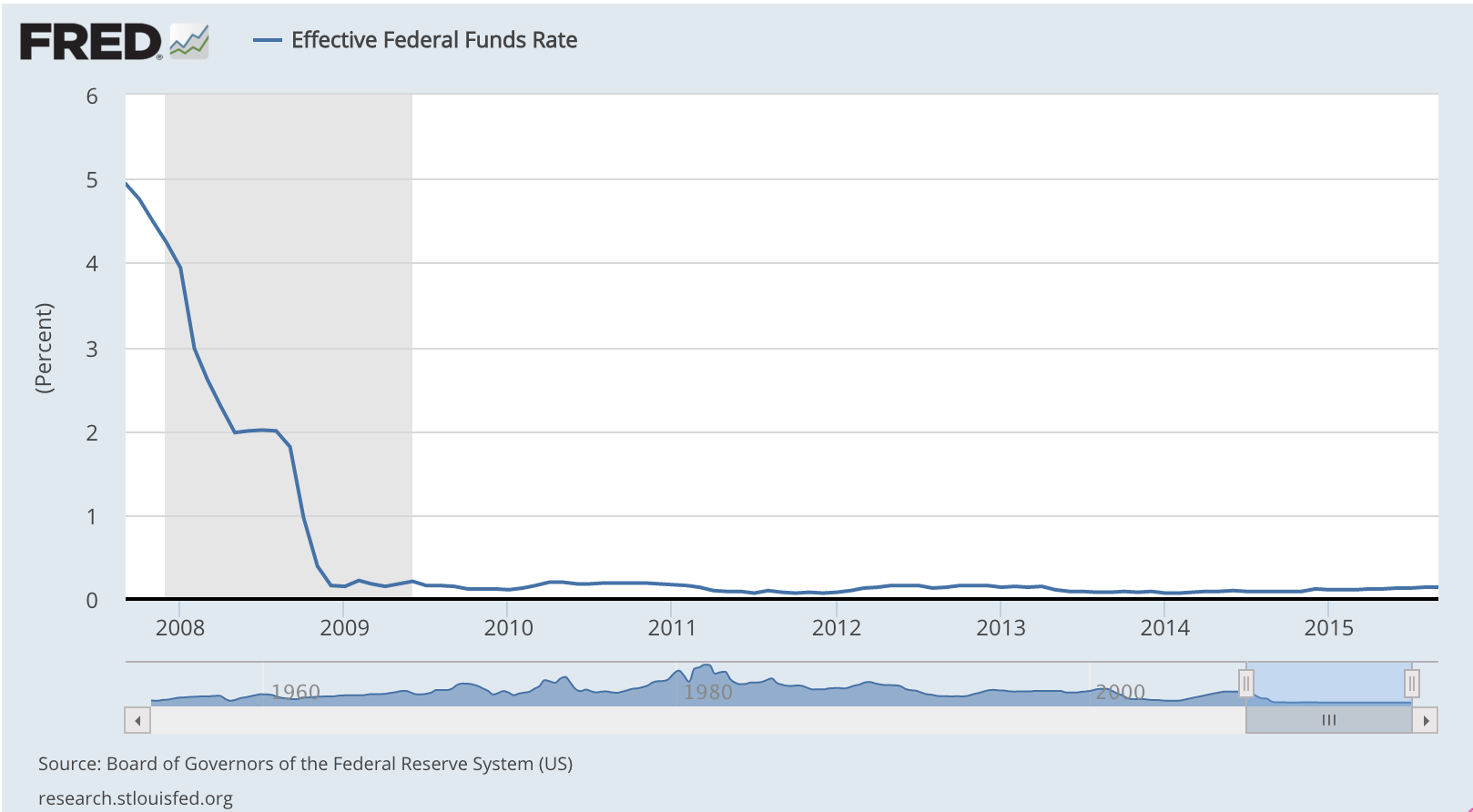

Speaking at the Brookings Institution, Williams said he expects the Federal Reserve to raise rates this year even though the real interest rate has fallen sharply since the recession hit in 2008 and has shown no signs of recovering.

“I see this as more of a warning, a red flag, that there is something going on here that isn’t really in our models, that maybe we don’t really understand as well as we think. We should dig down deeper and try to figure this out better,” he said.

He said zero interest rates show that the central bank has taken “enormous measures” to encourage growth. However, many companies today are sitting on cash and not willing to take more risks.

Today’s monetary policy “depends critically on fiscal and other policies” in both short and long run, he said. “We really need to think about other policies outside of monetary policy to get trend growth and aggregate demands higher.”

“If we (the Federal government) could come up with better fiscal policy, find a way to have the economy grow faster or have a stronger natural rate of interest, then that takes the pressure off of us to try to come up with other ways to do it, like through a large balance sheet or having a higher inflation target,” Williams said. “It also means we don’t have to turn to quantitative easing and other policies as much.”

The Federal Reserve voted to keep the interest rates unchanged this week and hinted it may raise rates at its December meeting.