WASHINGTON — While economists are divided on whether Japan’s large-scale quantitative easing will revive its economy, they do expect the country’s current monetary stimulus effort will increase inflation more significantly than the last five-year attempt.

The Bank of Japan announced it would maintain its current QE program on Nov. 19 after Japan’s gross domestic product shrank an annualized 0.8 % in the third quarter, following a revised 0.7 % decline in the second quarter.

Under the program, starting in October 2014, the central bank expanded its Japanese government long-term bond purchases, to 80 trillion yen ($650 billion) from 50 trillion yen, tripled its purchases of exchange-traded funds to 3 trillion yen from 1 trillion yen and also tripled real estate investment trust purchases to 90 billion yen from 30 billion yen.

Arthur Alexander, a Georgetown University professor specializing in Japanese economics, said Japan’s QE was a step “in the right direction.”

“Japan’s real GDP fell in the third quarter by 0.8%. However, this result provides little solid information for next year’s prospects,” Alexander said in an email. “Household consumption, residential investment and exports were solidly positive. The negative headline figure came mainly from the fall of private inventories.”

“The only way for QE to work is if the central bank can generate a credible expectation that they would allow a future acceleration of inflation,” added David Cook, an economics professor at Hong Kong University of Science and Technology, in an email interview.

Cook said Japan’s commitment to communicating regularly with the markets that it is committed to its inflationary policy in the current QE program is the “big difference” from the previous program.

At the current pace, the Bank of Japan will hold about 40% of the government bond market by the end of 2016 and close to 60% by the end of 2018, according to an International Monetary Fund paper.

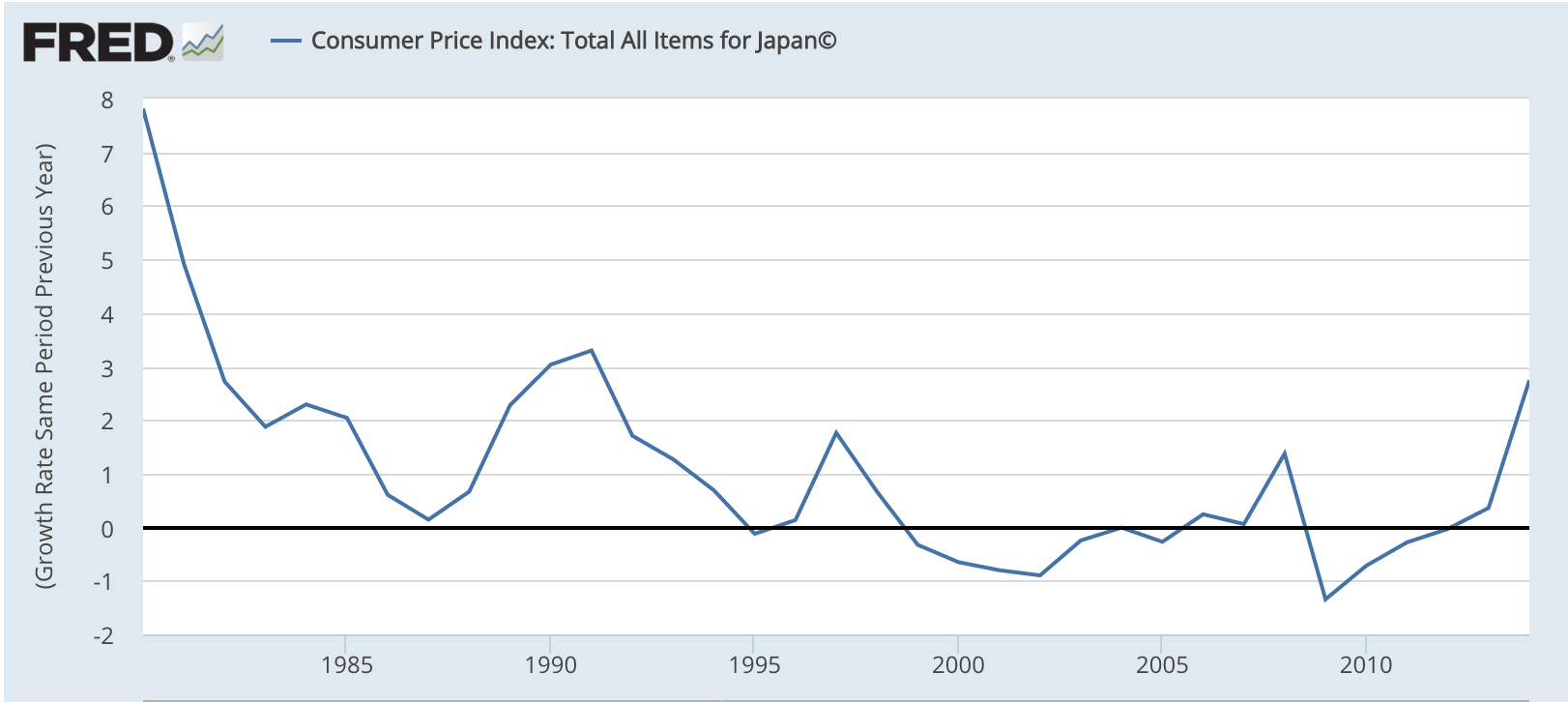

University of Chicago economics and finance professor Anil Kashyap said in an interview that the recent economic setback is only a “slight blip down” and he predicted that he expected Japan to hit its 2% inflation target in a year. “It is an extraordinary 15-year period they are trying to reverse and I think they have to stick with it.”

In October, inflation rose 0.3 % and core inflation, excluding food and energy, rose 0.7 %, according to Japan’s Statistics Bureau.

Bank of Japan Governor Haruhiko Kuroda, who assumed office in 2013, is a strong advocate of loose monetary policy. In 2013, he expanded purchasing the JGBs.

University of Michigan economics professor Miles Kimball, said Japan should keep stimulating its economy until it is overheated to a point that the inflation rate is higher than desired.

However, he said Japan’s large-scale QE might have some side effects that can’t be predicted. “We knows a fair bit about what it (quantitative easing) does with a certain dosage, and then you triple that dosage and nobody knows.”

Instead of quantitative easing, Kimball advocated negative interest rates. In a phone interview, he explained that cutting interest rates, even below zero, would have a more direct effect in stimulating the economy than increasing long-term bond purchases.

Scott Krisiloff, CEO at Avondale Asset Management in Santa Monica, Calif., cautioned that QE has very limited power to stimulate the two fundamental inputs of growth: population and productivity.

“QE tries to drive inflation, but inflation only boosts economic growth in nominal terms. It does not increase real output,” Krisiloff said in an email.

He said Japan’s real problem is lack of population growth, which was about 1% annually in the 1960s and 1970s, but has declined since, according to Japan’s Statistics Bureau. The Bureau reported that the population dropped 0.17% last year and projected a faster decline in the next three decades.

“In reality we should accept the fact that of course Japan will not grow faster than the rest of the world as long as its population is shrinking,” Krisiloff said.