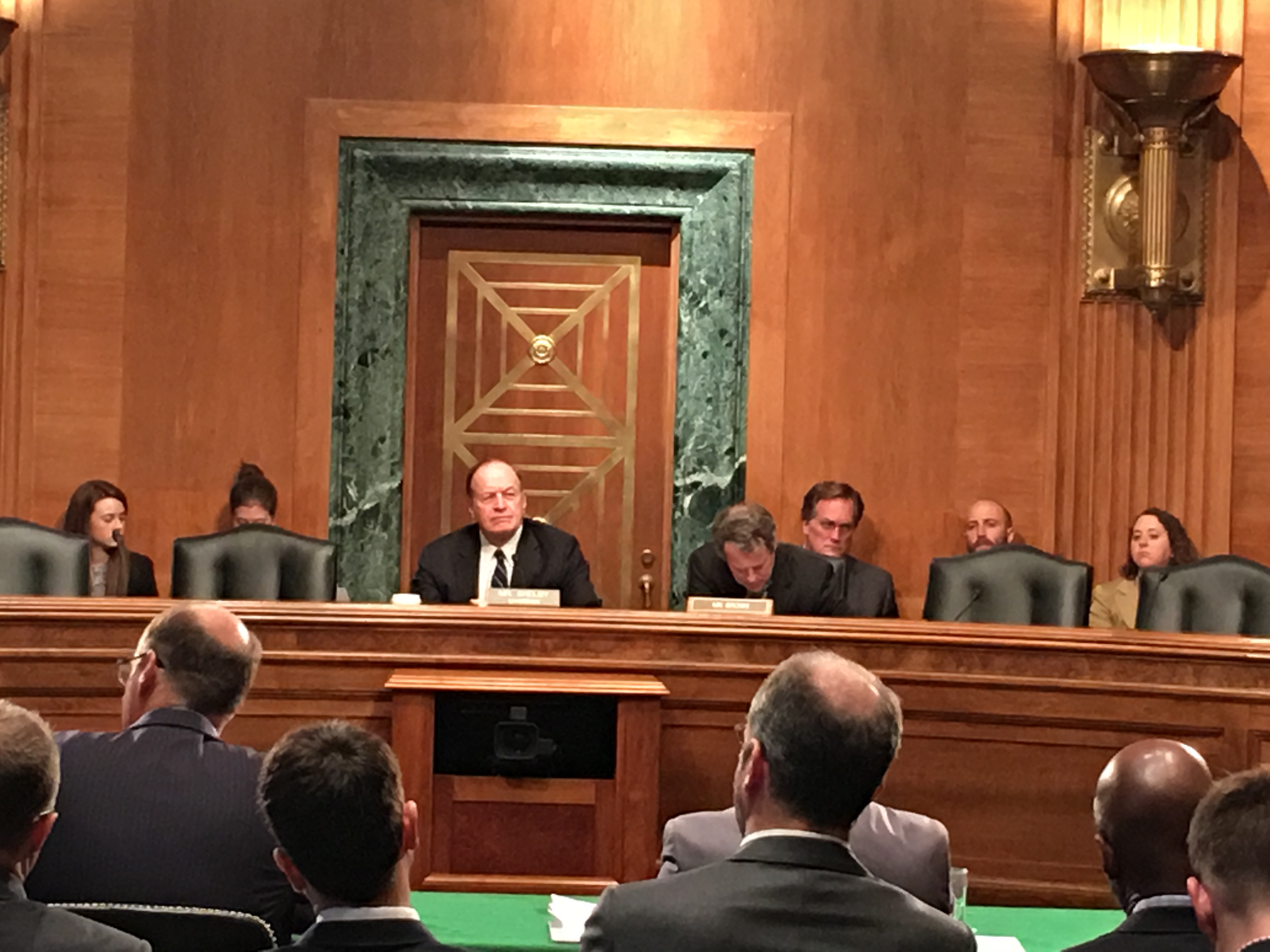

WASHINGTON — U.S. bank officials said Thursday the Basel III reforms are too complex and do not align with reality in the United States. The complaints about the international regulatory framework came before the Senate Banking, Housing and Urban Affairs Committee.

Since the 2008 financial crisis, triggered by the mortgage-backed securities bubble, federal banking agencies have tightened regulations on capital and liquidity in the banking system to reduce the potential for another financial crisis. Basel III, the current international framework was put in place by the Basel Committee on Banking Supervision in 2011 in an effort to improve risk management and require more disclosure and transparency in the banking sector.

Banks have to hold high-quality liquid assets, to help them handle severe market stress. High-quality liquid assets should be equal to their potential maximum funding needs for 30 days.

But Wayne A. Abernathy, executive vice president of financial institutions policy and regulatory affairs for the American Bankers Association, told the committee the Basel model does not work for U.S. banks. Abernathy said Americans actually tended to deposit more money domestically during the recent recession while Europeans tended to withdraw funds. In other words, the European-proposed global standard makes the liquidity management among American banks excessive.

Community banks also want relief from Basel III. These smaller banks suffered from the financial crisis and are still in recovery, according to Rebeca Romero Rainey, chairman and chief executive officer of Centinel Bank of Taos, a $215 million asset bank in Taos, New Mexico.

About 17,000 community bankers signed a petition proposing community banks be exempted from Basel III. They raised doubts about applicability of the rules to community banks and argued that the bank capital regulations are too complex and punitive.