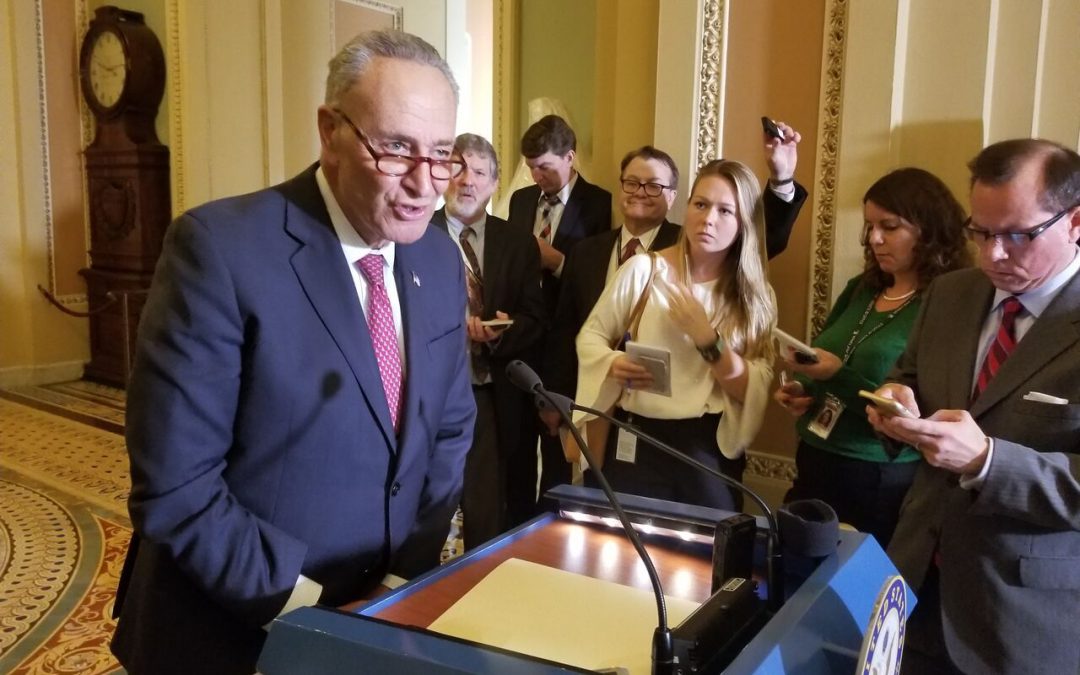

WASHINGTON –Senate Minority Leader Chuck Schumer said Tuesday that the Republican tax reform plan to be unveiled Wednesday is “open warfare on the middle class.”

The House bill to be publicly released Wednesday is expected to include cutting the corporate tax rate from 35 to 20 percent by 2022 and repealing inheritance taxes on multimillion-dollar estates.

“Taxes would go up on nearly one in three middle-class households,” Schumer said, “even though they promised no middle-class person would get a tax increase.”

President Donald Trump said he hoped to have House approval of the bill by Thanksgiving so that the Senate could then pass its version and he could sign it into law by Christmas.

House Ways and Means Committee Chairman Kevin Brady said the plan eliminates the deduction for state and local income taxes, but taxpayers would be able to continue to deduct local property taxes on their federal returns.

“Every time Republicans have found themselves in a pinch, they look to the middle class, not the ultra-wealthy, to carry the burden,” Schumer said. “They should have looked at the top one percent. They should have looked at the wealthiest corporations.”

Democratic lawmakers from high tax states like New York, New Jersey and Massachusetts said the repeal of the federal deduction for state and local taxes would cause their constituents to be taxed twice.

They also expressed concern that 401ks would be targeted. The quartet of senators also called for a bi-partisan tax reform bill, but have been denied.

“We’ve got ideas for how we can do tax reform in a way that doesn’t balloon the deficit and that helps build the American middle class,” Sen. Christopher Coons, D-Del., said.

Fellow Democratic Sen. Edward Markey of Massachusetts was blunter in his assessment.

“This isn’t a tax plan, this is a tax scam,” said Markey.