WASHINGTON– House Republicans unveiled a tax plan Thursday that would permanently reduce the corporate tax rate by over 40 percent, shrink the number of individual income tax brackets and cap certain deductions, including the home mortgage deduction, while increasing limits on standard deductions and child tax credits.

The plan, released after weeks of internal debate among Republican lawmakers, would take the corporate tax rate from 35 percent to 20 percent. It would also establish three individual tax brackets of 12, 25 and 35 percent while keeping the tax bracket for the highest earners at 39.6 percent. However, the plan would significantly raise the income threshold for the highest bracket to those earning $1 million a year, up from the current $418,000.

Republicans said the plan would benefit both middle-class families and American businesses of all sizes.

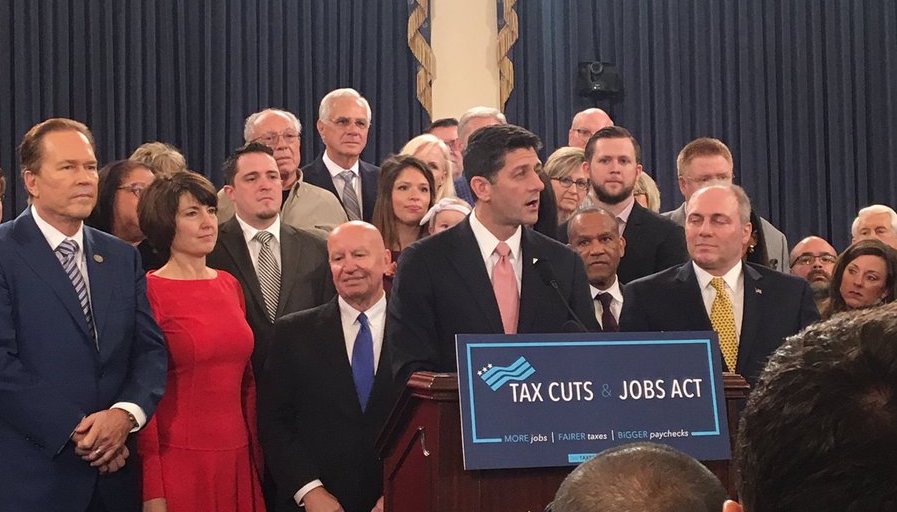

“We have not reformed since 1986 and the world is passing us by,” House Speaker Paul Ryan said at a news conference. “We have seen a flurry of U.S. companies moving overseas and becoming foreign companies. That will only increase if we stay at the back of the pack.”

The plan would cap deductions for property taxes at $10,000 and eliminate the mortgage interest deduction for mortgages over $500,000 on home purchases. It would expand the child tax credit to $1,600 and double standard deductions for both individuals $12,000 and couples to $24,000.

Democrats immediately responded, saying many parts of the bill would increase the budget deficit. They cited the bill’s plan to phase out the estate tax over six years, which taxes estates of more than $5 million, as well as reductions to corporate and individual rates as examples of how the bill too heavily favors wealthy Americans.

“It is a deficit-exploding, multi-trillion-dollar giveaway to the wealthiest and to corporations delivered on the backs of our children, our seniors and hardworking Americans,” said House Minority Leader Nancy Pelosi at the Democrats’ press conference.

But Republicans, with families standing behind their podium at the press conference, said the measure was designed specifically with families in mind.

“For a middle-income family of four making $59,000 a year, this bill delivers a tax cut of nearly $1,200,” said Rep. Kevin Brady of Texas, the Republicans’ top House tax writer. “That’s money you earned and you deserve to keep it.”

At the White House, President Donald Trump was joined by Ryan and Brady as he declared his support for the bill, echoing the GOP theme that it would help the middle class.

“This is a middle-income tax reduction, and it’s a very big one,” Trump said. “It will be the biggest tax reduction in the history of our country.”

Ryan guaranteed that the bill would pass, deflecting questions at his news conference about whether he would step down as House speaker if the House doesn’t pass the bill.

“We are going to get this done because it’s what we told the American people we’d do if we had the majority,” he said. “And guess what? We’re doing it.”

Brady predicted the bill would go to Trump for his signature by Christmas.