WASHINGTON—The nation’s top corporate executives say they are the most bullish about economic growth that they had been in nearly six years, according to a survey released Tuesday.

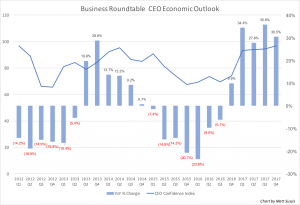

The Business Roundtable CEO Economic Outlook Index, which polls CEOs on their projections for capital expenditures, revenue growth and hiring, rose to 96.8 in the fourth quarter, compared to 94.5 last quarter and well above 74.2 last year. The index ranges from negative 50 to positive 150 — with a score of above 50 indicating expectations of economic growth and under 50 indicating contraction.

“The U.S. economy is strong, and business leaders are increasingly confident in continued economic growth, marked especially by their plans for additional capital investment,” said Business Roundtable Chairman Jamie Dimon, who also is chief executive at JP Morgan.

Capital expenditure projections were a bright spot, rising to 92.7 compared with 86.4 last quarter. Nearly half of CEOs said they expect to increase capital spending over the next six months while only 6 percent anticipate a drop.

CEOs’ sales expectations were also bullish, as the sub-index rose to 122 compared with 116.9 last quarter. While 76 percent of CEOs said they plan to grow revenue over the next six months, only 4 percent anticipate that sales would fall.

However, the outlook for hiring—while still positive—came in lower than last quarter. The employment sub-index fell to 75.7 compared with 80.2 in the third quarter of 2017 as about the same number of CEOs said they plan to hire more people but more top executives than last quarter anticipate increased layoffs.

The advocacy group said that while the overall index figures were promising, much of the optimism was dependent upon the Trump administration passing pro-business policies.

“To continue this momentum, it is critical that we enact pro-growth tax reform that will level the playing field for U.S. businesses to be globally competitive,” said Dimon.

Senate Republicans passed a tax bill Saturday that would reduce the corporate tax rate from 35 percent to 20 percent and grant businesses a one-time cash repatriation holiday. House and Senate GOP leadership now is trying to reconcile the chambers’ differing versions of the measure. They hope to have a final version on President Donald Trump’s desk by the year’s end.