WASHINGTON — A senate committee is considering a proposal to give the FTC more authority to supervise credit bureaus and impose harsher civil penalties from those that don’t follow standard credit reporting procedures and report wrongful data.

A Federal Trade Commission official told the Senate Banking, Housing and Urban Affairs Committee Thursday that 5 to 10 percent of credit reports contain errors, and it can take years for the FTC to investigate a dispute. Credit reporting agencies have little incentive to strictly follow standard reporting procedures, but tough penalties for reporting wrong data could be the answer, said Sen. Chris Van Hollen, D-Md.

Studies show that about 25 percent of consumers identified errors on their credit reports that might affect their credit scores, and 80% of those who file disputes get modifications, said Maneesha Mithal, associate director for the division of privacy and identity protection at the Federal Trade Commission. Several senators expressed concerns that this could affect more than 10 million U.S. citizens.

Sen. John Kennedy, R-La., said the complex dispute and complaint process would be too time and effort consuming for average citizens with day jobs to take care of. Kennedy is developing legislation with Sen. Brian Schatz, D-Hawaii, to make credit companies create internet portals where consumers cannot only check and freeze their credit reports, but also correct them.

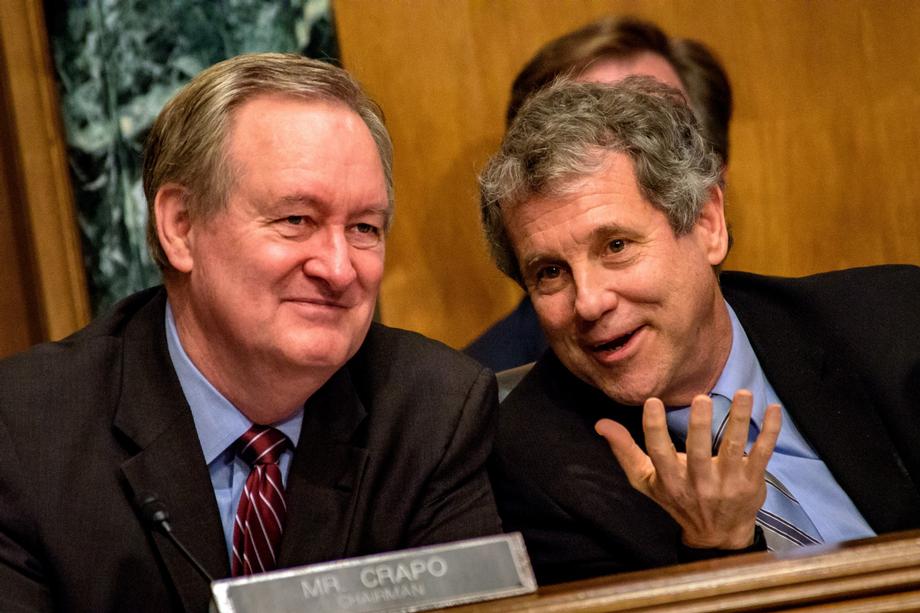

Sen. Sherrod Brown, D-Ohio, echoed this concern and said the system is too complicated for an individual consumer, which gives credit bureaus too much power over its customers.

“The credit providers know where the power of the society resides. It’s not with consumers, it’s not with employers. It’s with credit reporting companies,” Brown said.

Though Consumer Financial Protection Bureau has broad supervisory and enforcement authority over some credit reporting agencies, it does not have rulemaking authority over federal banking agencies and several other national commissions, CFPB Assistant Director of Supervision Policy Peggy Twohig said.

The Committee reviewed some of the 20 credit reporting-related bills during the hearing, according to a CQ report.