Much more needs to be done to protect consumers in the face of the coronavirus pandemic, a representative of a New York-based advocacy group says.

“People start to make tough decisions and that makes them more vulnerable to unfair practices and then encourages the worst kinds of predators to take advantage of them,” said Russ Haven, New York Public Interest Research Group general counsel.In New York State, the Legislature should fundamentally change the power dynamic between consumers and big businesses, Haven said. If people sue their insurance company in New York, they need to pay for their attorneys even when they win, while some states allow consumers to get their attorney fees back. Haven said that doesn’t result in an increase in court cases because the insurance companies are more likely to settle consumers’ complaints fairly.

“It’s not enough for consumers just to try and learn what they need to do to fix their own situation or get the best outcome,” Haven said. “If consumers will engage in contacting their state legislators and their congressional representative, we can really change the laws to make it better for everyone going forward and to make the system fairer.”

The issue of consumer protections has come to the forefront these days.

A spokesperson for the New York State Division of Consumer Protection said in an email that consumer complaint volumes from March 1 to July 31 increased by 298 percent, compared with the same time period in 2019.

Kirsten Keefe, a senior staff attorney working on policy issues regarding mortgage lending at Empire Justice Center’s Albany office, said more minority families report that they’re unable to make their mortgage payments compared to their white counterparts.

“In the consumer community, it’s expensive to be poor,” said Chuck Bell, a program director for the advocacy division of Consumer Reports. “You get charged more for everything.”

Communities of color and non-English consumers are disproportionately targeted by fraudsters, Bell said. He said they have fewer resources to protect their rights when encountering scams because of the racial wealth gap. Another concern is that people might not get the right information from the sellers and servicers if their primary language is not English, Bell said.

Bell said New York has a strong Borrower Bill of Rights, “because our experience has been that if the states don’t act, consumers will be unprotected.”

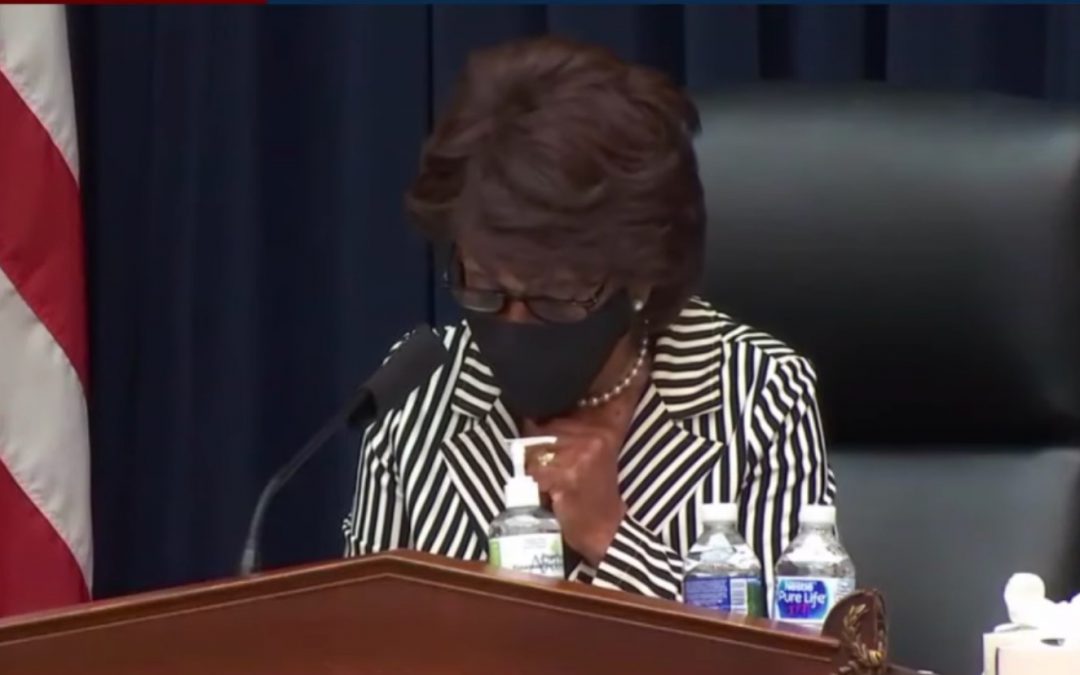

On July 30, the federal Consumer Financial Protection Bureau took heavy criticism during a House Committee on Financial Services hearing in Washington D.C.

Committee Chairwoman Maxine Waters, D-Calif., accused the bureau of failing to protect consumers during the pandemic, and that the bureau director’s actions were “a betrayal of consumers.”

Waters said actions taken by the CFPB since March, such as rolling back regulation on payday loans and weakening the Home Mortgage Disclosure Act, have helped sabotage its role in protecting consumers.

Consumers encounter major hardships “in working with payday lenders, mortgage servicers, credit card companies, and the credit reporting bureaus” and report “long wait times, inconsistent information from consumer representatives, and a lack of follow up,” Waters said.

Waters said Consumer Bureau Director Kathy Kraninger, who attended the hearing, “has done next to nothing of substance about any of this,” Waters said. “Instead, she has focused the Consumer Bureau on weakening critical consumer protections, relaxing enforcement against financial institutions, and undermining the agency from the inside.”

Kraninger said the bureau offers videos and blogs in seven languages to adapt to the changing dynamic. The CFPB has reached out to the communities of color “to make sure that they have the information they need and can get increased access to these programs,” she added.

When reached, John Breyault, the vice president of Public Policy, Telecommunication and Fraud at National Consumer League, said the CFPB should not be politicized. The bureau used to have a single director who could only be removed for cause. However, the Trump administration tried to push the CFPB to become a commission-based agency, rolling back many strong consumer protections like the prepaid rule and the payday loan rule.

“Ever since President Trump took office, they have been trying to make the CFPB progressively weaker and weaker. And unfortunately, they’ve been very successful at that,” Breyault said. “What would make a difference is if the next administration stops trying to defang the CFPB.”

Financial strain increases consumer vulnerabilities. Breyault said social media platforms like Facebook and Twitter have made it easier for fraudsters to reach victims. He said people under emotional and economic stress caused by the pandemic are more vulnerable.

Breyault said making the information accessible to people in their own language is important, but more needs to be done to identify how communities of color are specifically being harmed by marketplace practices.

“To the extent that the CFPB may not be doing that, I think they should devote more resources to doing so,” Breyault said.