WASHINGTON — Members of Congress on Wednesday maintained that federal regulators, as well as bank executives, should be held accountable for the failure of the Silicon Valley Bank and other two banks.

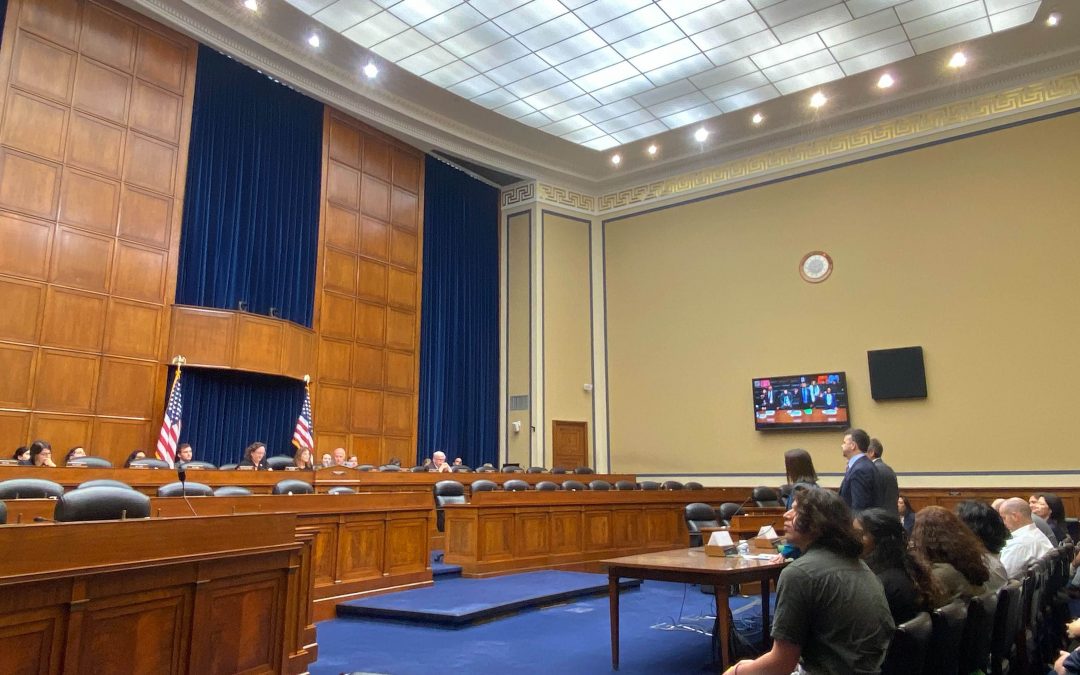

“The executives and the board of Silicon Valley Bank clearly dropped the ball,” Rep. Lisa McClain, R-Mich., said at a House Subcommittee on Health Care and Financial Services hearing.

“The fact that there have not been any resignations or any firings at the top of the Fed and the [Federal Deposit Insurance Corp.} is unfortunate, but not surprising, for the [Biden] administration.”

The Federal Reserve is responsible for identifying and correcting unsafe and unsound practices before they lead to a bank’s failure through the dynamic markets, Jeremy Newell, a senior fellow at the Bank Policy Institute, told the subcommittee.

However, under its watch, three banks have failed this year, resulting in more than $35 billion being taken from the Deposit Insurance Fund to resolve the crisis, according to an FDIC’s estimation.

Before the failures, the Federal Reserve Bank of San Francisco and FDIC had recognized financial risks at both Silicon Valley Bank and Signature Bank, but neither regulating agency acted to prevent the bank failures, Michael Clements, director of Government Accountability Office’s financial markets and community investment team, noted in his testimony.

In April, the Federal Reserve published a report reflecting on its supervision and regulation of Silicon Valley Bank. In 2019, the Federal Reserve revised its framework to enhance the standards of the eight global systemically important banks, but reduced requirements for other large banks.

“For Silicon Valley Bank, this resulted in lower supervisory and regulatory requirements, including lower capital and liquidity requirements. While higher supervisory and regulatory requirements may not have prevented the firm’s failure, they would likely have bolstered the resilience of Silicon Valley Bank,” the report said.

However, Newell said the Federal Reserve was being “too assertive” and provided a wrong diagnosis without fully acknowledging the whole picture.

In his view, federal regulators have placed too much emphasis on non-financial risks and regulatory procedures rather than addressing financial vulnerabilities.

This hearing is another step of the House Committee of Oversight and Accountability’s investigation into regulation shortcomings in bank failures.

On April 27, Rep. James Comer, R-Ky., chairman of the House Committee on Oversight and Accountability, and McClain, chairwoman of the Subcommittee on Health Care and Financial Services, sent an official letter to Mary Colleen Daly, president and CEO of the San Francisco Federal Reserve.

In the letter, the lawmakers requested documents such as audit reports, communications, and lists of individuals involved in overseeing Silicon Valley Bank within the Federal Reserve.

“I wish I could say this is Congress’ first hearing to dig into the causes of bank failure. It’s not,” said Rep. Katie Porter, D.-Calif. “That’s because when it comes to regulating our banks, Congress has a short-term memory on what works and what doesn’t. ”

Porter said that bank failure increases when Congress removes regulations. However, Congress is easily influenced by bank lobbyists who want less regulation.