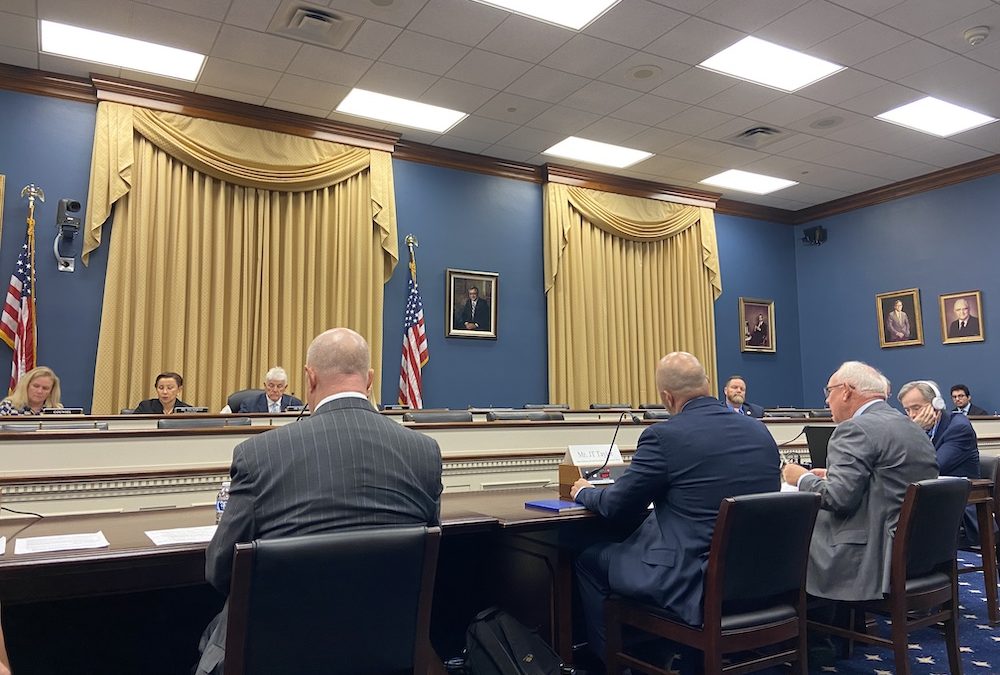

WASHINGTON — The House Small Business Committee appealed to the private sector on Wednesday to help recoup billions of stolen pandemic loan funds.

Nydia M. Velázquez, D-N.Y., ranking member of the House Small Business Committee, said it was clear that the Small Business Administration is not an investigative agency, and lacks the resources to do the job on its own.

“It’s a top priority of this Committee to recoup these stolen funds,” said chairman Roger Williams, R-Texas in a press release. “And yesterday’s hearing looked at new, innovative private sector solutions to do just that.”

The Small Business Administration offered the Paycheck Protection Program (PPP) and COVID Economic Injury Disaster Loan during the pandemic. These programs were abused by what the House has coined “bad actors,” because of the improper security measures to protect against fraud.

This fraud is estimated between $36 billion and $200 billion, depending on who you ask.

Rep. Aaron Bean, R-Fla., and the “Swindler Barbie” poster with examples of identity theft in pandemic loans. (Kelly Adkins/MEDILL NEWS SERVICE)

Whatever the total amount, it would take over 100 years to investigate and retrieve the money, according to the Inspector General of the Small Business Administration. Time is of the essence, because there’s a 10-year statute of limitations to prosecute the fraud.

When asked by Rep. Lalota, R-N.Y., if pursuing the investigation was wise, witness Richard Breeden, a former chairman of the Securities and Exchange Commission, said it would be harmful not to.

“It sends a message that, okay, you can play around the edges and people just won’t bother,” said Breeden. “And I think the principle that if you steal from your neighbors, you steal from your fellow citizens, that will always be a matter worthy of government’s attention is the right message to send.”

One suggestion was the implementation of an in-house whistleblower program to sniff out fraudsters, similar to the IRS Whistleblower Office established by the Tax Relief and Health Care Act of 2006.

“Whistleblowers give you the keys to the kingdom,” said witness Dean Zerbe, former Senior Counsel and Tax Counsel for the Senate Finance Committee. “Fraud is purposefully being hidden, it is hidden in the nature of it. If you want to get it, you have to get insider reforms and knowledgeable, detailed information.

According to a recent study by the Association of Certified Fraud Examiners, whistleblowers catch 42% of all frauds.

Yet, motivating tipsters to assist in the identification of bad actors is different from investigating and convicting them for their crimes.

Linda Miller, former deputy executive director of the Pandemic Response Accountability Committee, said there would not be enough U.S. attorneys to investigate whether the whistleblowers’ allegations are accurate.

“We all have a common enemy, it is people stealing money from American taxpayers,” she said. “We should all be coming together and finding ways to get back taxpayer dollars, and that solution needs to be bipartisan and unanimous.”

President Biden supported a similar bipartisan plan in a proposal about the stolen funds in March of this year.