WASHINGTON – Federal officials, banks and non-profit groups met Wednesday to share solutions to help more Black and Latino Americans buy houses and build intergenerational wealth.

DC-based think tank Urban Institute and advocacy organization Living Cities partnered to present a panel discussion, “Closing the Gap: Barriers and Solutions for Equitable Homeownership.” Owning a house is one of the strongest ways to create generational wealth, according to Urban Institute President Sarah Rosen Wartell.

In order to lower the current disparities, panelists presented a multitude of actions and steps to level the playing field. Many of these solutions are still awaiting implementation and concrete results.

For instance, federal and private partners are working together to recruit more people of color to become appraisers and counter the biases that contribute to depressed home prices in Black and Hispanic communities.

“We are building a future in which no family needs to hide a family photo to receive a fair home appraisal,” said Adrianne Todman, Deputy Secretary of the U.S. Department of Housing and Urban Development. “A future where young people, no matter their race, their family or socio-economic background, can realistically save for and purchase a home if that is what they choose to do.”

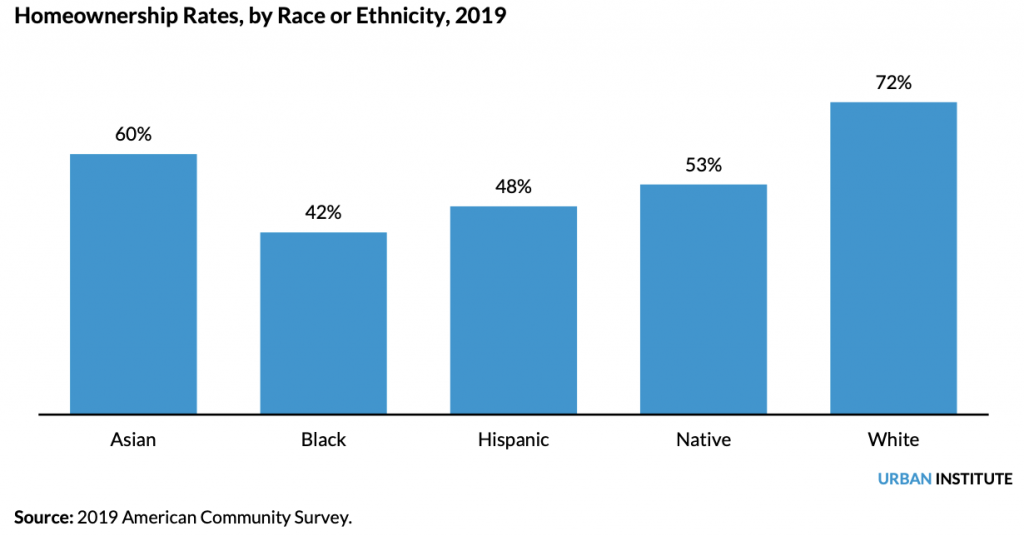

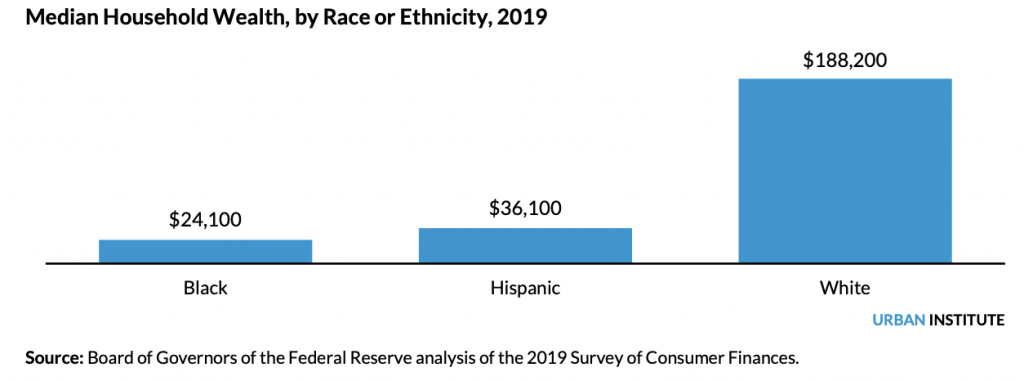

Research from 2022 showed that Black and Latinx Americans still lag far behind white counterparts in homeownership and median household wealth, with homeownership rates that are 30 and 24 percent lower, respectively. Black and Hispanic households’ median wealth was more than $150,000 short of white households.

Household wealth is calculated by subtracting the household’s total liabilities from its total assets. (Charts courtesy of the Urban Institute.)

“It’s almost as if we have a sense of amnesia at times about what those things were that worked, and how we established this whole white middle class,” Perry said. “Some of those same things we need to do now for the people who weren’t permitted to take advantage of those things when we did that 50, 60 years ago.”

A solution being tested in cities around the nation is a land trust, where renters or homeowners receive assistance from an organization that owns the land. The trusts work to lower the burden on residents while also allowing them to live somewhere they otherwise may not have been able to afford. However, Brian Smith, Founder and CEO of Fortis Capital, cautions that some land trust models make it difficult for residents to build wealth.

“Traditionally, land trusts have been, for the most part, white-owned nonprofit organizations that have acquired a lot of land in poor black and brown neighborhoods,” Smith said. “Executive directors make nice salaries, their staff make nice salaries, but the equity, the ownership and the land, which is the most important thing, is what ends up staying with that organization.”