WASHINGTON – Nonprofit financial institutions that fund underserved communities urged Congress not to put this work on the backburner after a House proposal to slash the budget for these institutions by 14%.

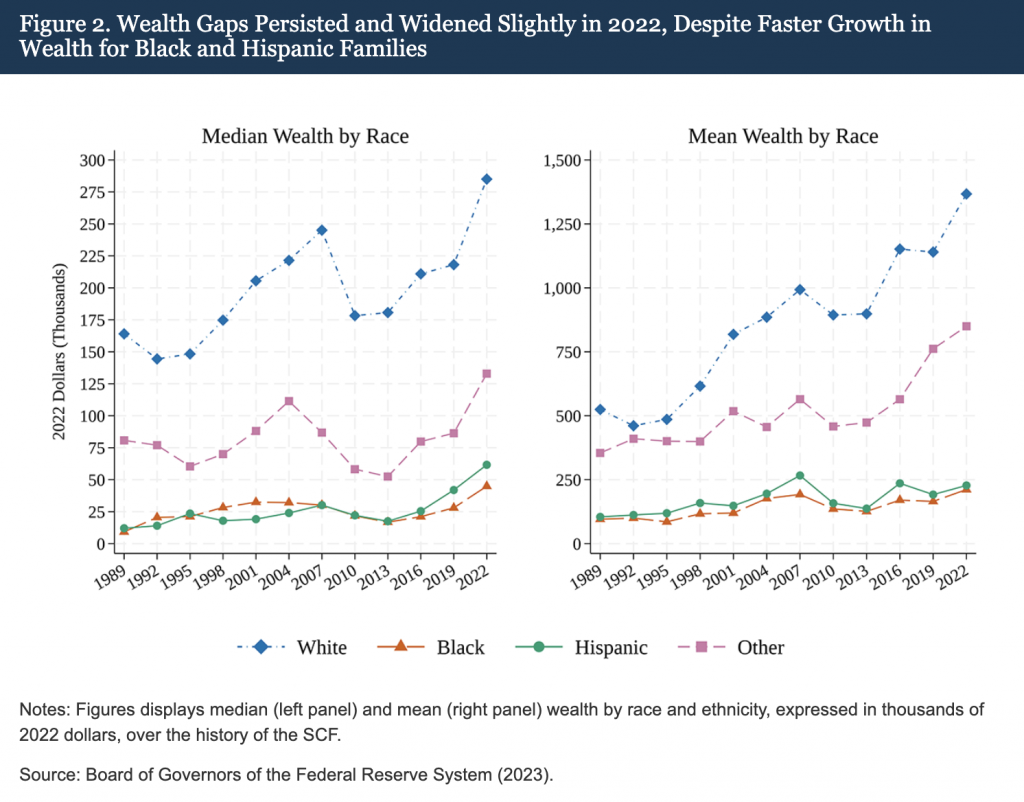

The wealth gap has persisted in recent years. Families of color had less buying power than their white counterparts and limited access to traditional banking resources. In 2022, the Federal Reserve measured the ratio of a white household’s wealth to a non-white household. For every $100 held in a typical white family, the typical Black family had $16, and the typical Hispanic family, $10.

These households have a difficult time getting capital to buy homes or open businesses, which is why Congress incentivizes local financial institutions to help fill the equity gaps. But House Republicans in July proposed cutting funding for a key program by 14% to $278 million.

“BIPOC (Black, Indigenous, people of color) small businesses and low-income communities require unique and innovative approaches to opportunity,” Renay Dossman, president and chief executive officer of the Neighborhood Development Center, told the Senate Banking Committee in October.

The wealth gaps between white, Black and Hispanic families according to the Federal Reserve’s data.

The Community Development Financial Institutions Fund, commonly referred to as the CDFI fund, is a capital investment program offered by the Department of Treasury. Local financial institutions can apply for the certification, which opens up subsidized funds and grant money. The mission is to provide capital to fill in equity gaps for low-income areas, families of color, Natives, rural poverty zones, and other underserved communities.

Dossman’s organization, which operates out of Minnesota, is one of over 1,300 certified companies that address specific needs.

Every dollar of federal funding is matched with $10 of private funds, according to Sen. Tina Smith, D-MN, who chairs the Senate Banking Committee.

The program helps people in cities and rural areas alike. She referenced a study from the PEW Research Center that found rural counties are about 50% more likely than urban counties to have high rates of concentrated poverty.

The Oweesta Corporation is one of 66 certified Native American organizations. This number has grown from two certifications in 1999. The Minneapolis Federal Reserve released data last year that showed the gap in net worth between whites and Native Americans was 32 to 1.

Due to their rural communities, many Native Americans lack basic financial services such as access to a bank or ATM. This makes families more susceptible to predatory lenders, according to the Oweesta Corporation’s President and Chief Executive Officer, Chrystel Cornelius.

“So when we look at the imperative nature of what CDFIs have done over the past 25 years,” she said, “Our institutions are the financial pillars of our economies. Of our tribal communities, they are a light and a beacon of hope.”

The Treasury released its request for $341 million in fiscal year 2024, a 5% increase from last year. The Republican-led House Appropriations committee introduced legislation that would cut the budget 14%, to $278 million.

Ranking member Sen. Cynthia Lummis, R-WY, called upon the experts, asking how Congress could provide stable forms of capital to allow institutions to continue the work.

They suggested Congress fund existing bipartisan proposals.

“Accountability is important, but so is funding the full CDFI ecosystem,” said Dossman.

Dossman said one way to do this could be making the current bond program for certified institutions permanent, which was proposed by Sen. Smith and Sen. Michael Round, R-SD.

Cornelius pushed for the The Affordable Housing Credit Improvement Act. This proposal, also bipartisan, would include an increase in housing credit allocations that Native American communities could use toward their assets.