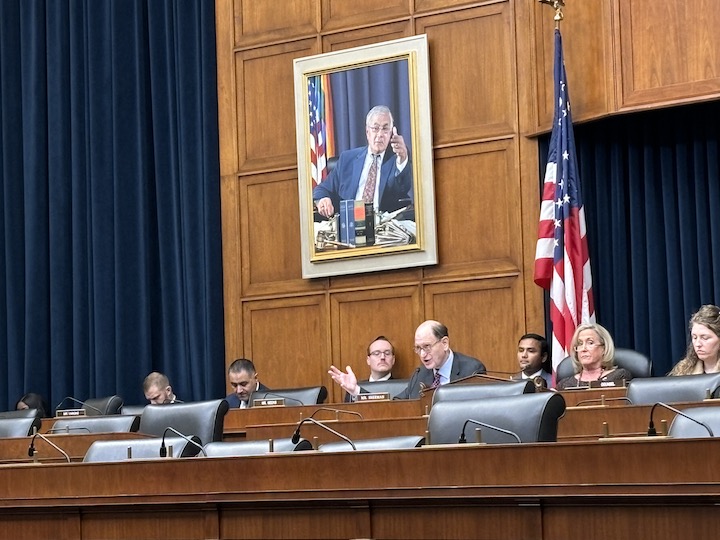

WASHINGTON – Experts and former employees of the Securities and Exchange Commission criticized its current leadership’s rule-making at a House Financial Services committee hearing Thursday. The hearing was called to discuss the “rule-making agenda,” and its impact on the capital markets and investors.

Under the leadership of chairman Gary Gensler, the SEC has proposed 30 new rules slated for adoption this fall and next spring, a total of 63 rules projected by the end of his term. Gensler came to term in 2021, and will serve until 2026. One of the 30, which was formally adopted Thursday, requires facilities that exchange securities to report to the SEC. According to the Securities Industry and Financial Markets Association, 63 rules would be 47% more than the Trump Administration’s Jay Clayton’s 43 rules and 186% more than the Obama Administration’s Mary Jo White’s 22 rules.

These rules typically include disclosure requirements, which protect investors from making uninformed decisions. Rules also aim to maintain an efficient market and facilitate capital formation, according to the SEC’s mission statement.

Law requires that when the SEC proposes a rule, it must allow enough time for Congress to comment. The Chamber of Commerce filed a lawsuit against the SEC this year, claiming that a disclosure rule, about companies repurchasing its own public stock, violated this law. This week, the Fifth Circuit delivered an opinion by the circuit judges which held the SEC acted “arbitrarily and capriciously” with the rule’s adoption, and did not provide the public with a meaningful opportunity to comment.

“The regulatory tsunami caused by the SEC’s hurried rulemaking process is damaging American capital markets,” Tom Quaadman, Executive Vice President of the U.S. Chamber’s Center for Capital Markets Competitiveness, said in a statement earlier this week.

“The Chamber will not shy away from litigation where necessary to protect companies’ abilities to act in the best interests of their investors,” it wrote.

A former senior SEC official warned an “onslaught of rules” could make compliance impossible due to finite resources, including monetary and human capital.

“We could get to the point where there is a regulator-created systematic risk, because we break something in the market,” said Dalia Blass. “We are a very complex tier market, and if you move too many pieces at once, which is what we are doing here, something’s going to break.”

Rep. Ann Wagner, R-MO, the committee chair, and other committee members had formally written to the SEC with their recommendations on multiple rules. It had been over 30 days since, with no response.

“Regulators should not use their position to experiment with academic pet projects,” said Wagner. “Transformative changes must be meticulously crafted and thoroughly vetted to prevent indirect cost and cumulative effects.”

A spokesperson of the SEC declined to comment on the accusations made at the committee hearing.

A statement issued by Gensler in September stated the rule-making is part of upholding the standards set in a seminal SEC report in 1963, which called for “broader public participation” in changing markets. The statement said 18 rules have been re-opened in the past two years of term for further public comment.

“We also have finalized 24 rulemakings, nearly all of which have changed based on public feedback,” wrote Gensler.

Ranking member, Rep. Bradley Sherman, D-CA, recognized the SEC for its work.

“I think that it’s important to focus on some of the things the SEC is doing right,” Sherman said.

In particular, he praised the SEC for clamping down on cryptocurrency.